Simple question - which stock would you trade?

Stock A) Currently has a stock rank of 80, but when you load the historical page you see it had a stock rank of 99 a month ago. Dropping 19 points.

Or

Stock B) Currently has a stock rank of 60, but when you load the historical page you see it had a stock rank of 41 a month ago. Gaining 19 points.

*Both companies have similar chart patterns, and in the same sector. The question is focusing on whether a gain in stock rank over a period of time trumps a higher stock rank on the present day.

Cheers

Dan

In theory, the Stock Rank has no "memory". It just captures in some sense the probability that the stock is likely to appreciate in value over the next year or so, as things stand at the time it is calculated.

So no meaning can be assigned to its trend or how fast it is changing. This merely reflects a change in the assessment of the stock's merit due to the various factors which make up the way the rank is calculated.

So a stock with SR 80 has a higher probability over the medium term (about 12 months) of performing better than a stock with SR 60 regardless of how they arrived at their current value.

But something you might want to factor into your decision is the risk rating. An adventurous stock with SR 80 is a "riskier" ride than a balanced stock with SR 80 for example. (Where "risk" means that it is more likely to perform very well or very badly, rather than moderately well or badly.)

Below are a couple of examples which show how different risk ratings affect the amount the price is swinging about, and also show how much the Stock Rank can change over time.

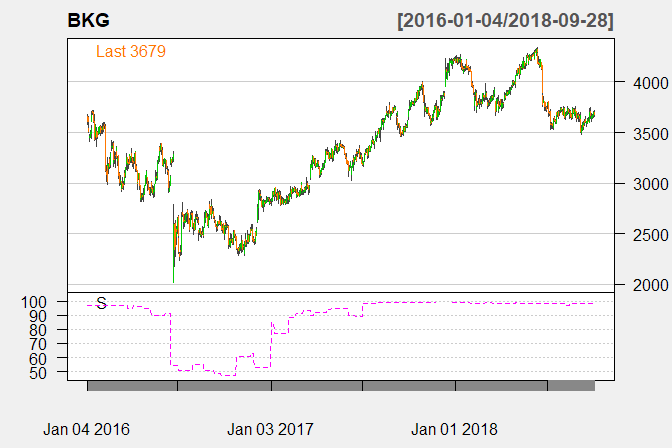

Here's the stock rank history of Berkeley Group (LON:BKG) over the last two years - which is an adventurous stock with a SR in the high 90s. But back in early 2016 it still managed to drop about -35% with a SR > 90.

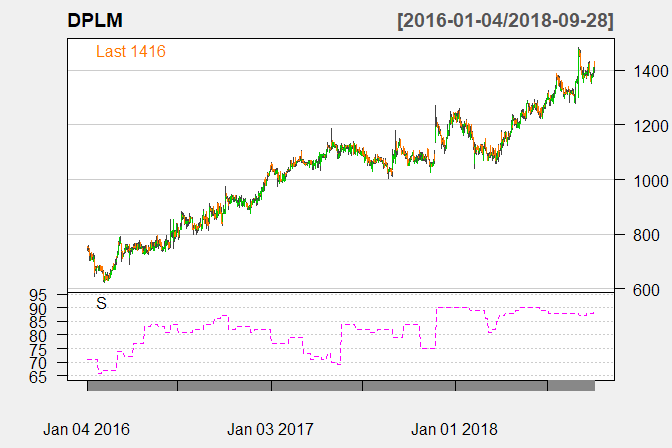

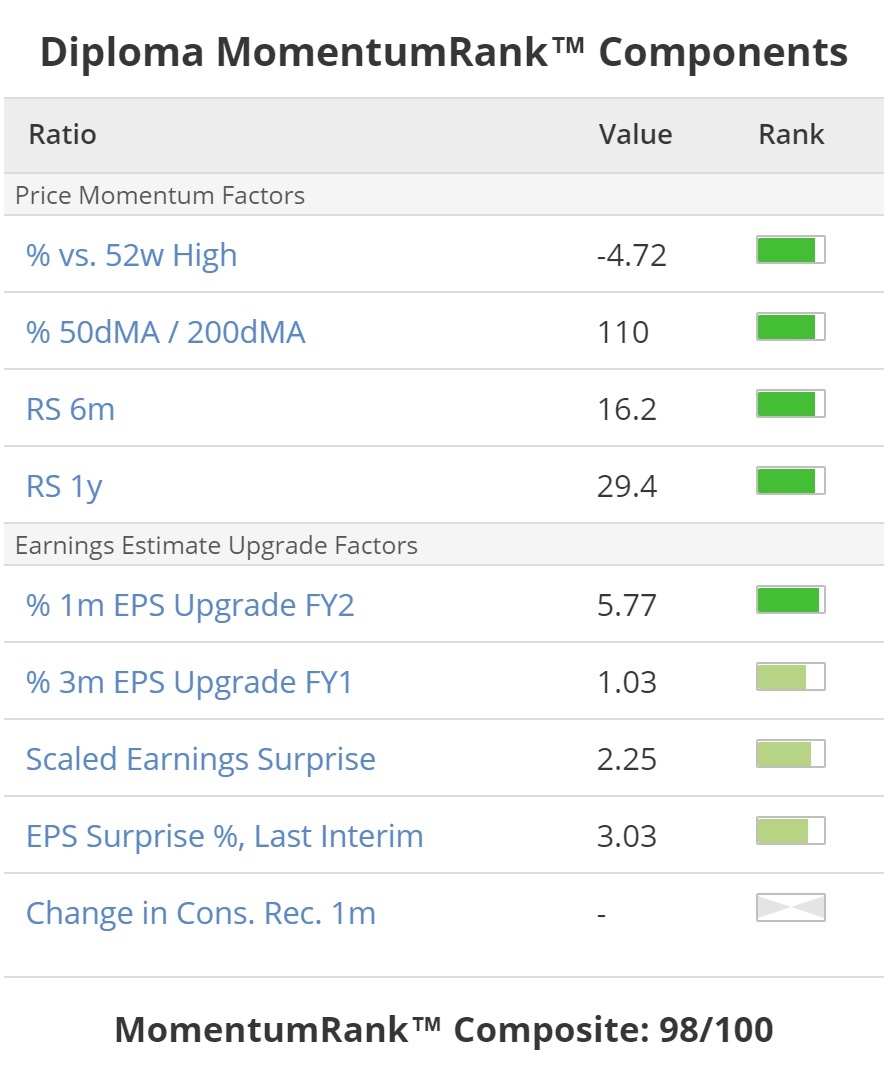

Here is the stock rank history of Diploma (LON:DPLM) which is a balanced stock with an SR > 90 at present.