Since reaching a high of 2,230p on January 16th, the Rockrose Energy (LON:RRE) share price has tumbled by 35%. Today its market cap stands at £191m. Its recent update presentation shows a cash hoard of some $371m ($55m of which is restricted). Converted at current rates, that is £289m, or 151% of its market cap. Strip out the $55m of securitised cash, and the remaining $316m (£246.5m) is 129% of market cap.

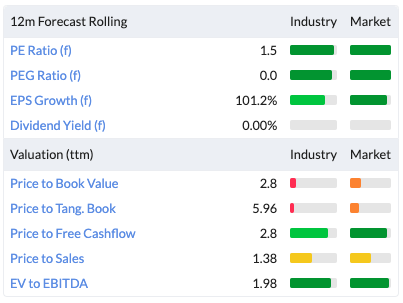

Priced at just 1.5 times forecast earnings and 2.8 times trailing twelve month free cash flow, you’ll be hard pressed to find a cheaper stock than this North Sea oil & gas producer on an earnings and cash flow basis.

When you find a company on this sort of valuation, usually it is either worth nothing or it is worth multiples of its current price.

Why is Rockrose so cheap? In a word: decommissioning. Rockrose is assembling a collection of mature north sea oil and gas operating assets. The key word here is mature. When oil and gas assets stop producing, wells need to be plugged up and pipelines must be cleaned. It’s an expensive business.

RockRose says in its most recent update to shareholders that it has an Abandonment Half-Life (the date at which half of RRE’s abandonment expenditure has been incurred) of 2030. Operators are quickly getting better at extending the lives of these assets, however.

The group says it has 82MMboe of 2P + 2C Reserves and is “designed to do business in the harsh environment of sub-$50 per barrel oil prices”. If you put that into practice then, and apply a price of $40 to its barrels of oil equivalent, you calculate that this £191m market cap company is sitting on about $3.28bn of proven and probable reserves.

RockRose could well be worth many times more than 1.4 times forecast earnings, but getting to grips with this quickly evolving company is tricky...

A step up in profitability... and uncertainty?

Halfway through 2019, RockRose purchased Marathon Oil. This was a material acquisition. Looking at the indicative financial statements presented in the 2019 prospectus (page 105), we can see that the Dyas and Marathon acquisitions would have changed FY18 income statement:

- Revenue from $153m to $603m

- Operating profit from $25m to $350m

- Profit for the year from $39m to $230m

It also…

.jpg)