Rolls-Royce shares have long been a favourite of defensive and income-seeking investors. It’s easy to see why if you look at its long record of inflation beating dividend growth.

The company almost doubled its dividend between 1992 and 2002 and more than doubled it in the following decade. That’s no mean feat for such a large company, but investors are expecting even more in the future.

Today Rolls-Royce shares stand at 1,045p and the dividend yield is just 2.1%. With the FTSE 100’s yield currently at 3.5% investors are expecting Rolls-Royce to continue to grow its dividend significantly faster than the average large-cap company.

And that may actually be a reasonable assumption, but it’s not without its risks.

The company has grown rapidly in recent years

Rolls-Royce has built itself into an extremely successful global business supplying and servicing a variety of engines, motors and power systems into the aviation, marine and energy industries.

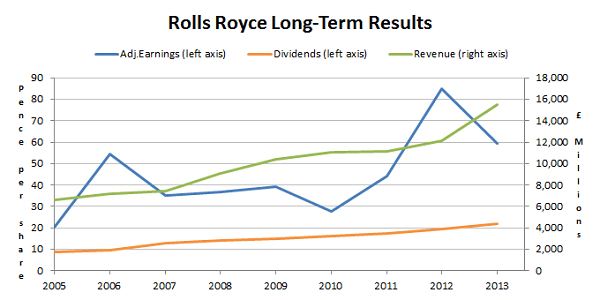

You can see its financial performance over recent years in the chart below:

In summary:

- Revenues have grown by about 10% a year

- Earnings have grown by about 9% a year

- Dividends have grown by about 11% a year

In comparison the FTSE 100 grew those fundamentals by about 2% a year during the same period, not even keeping pace with inflation.

Investors expect that rapid growth to continue

The low dividend yield from Rolls-Royce shares implies that investors are giving up some income today in expectation of more income tomorrow. In other words, rapid dividend growth must be maintained in order to justify the stock’s current high valuation and low yield.

But is market beating growth a reasonable assumption?

I think it probably is. Rolls-Royce operates globally in various markets, some of which are still growing quite rapidly and it has a relatively defensible position as a leading supplier of engines, power systems and related services to those markets.

It has proven itself to be a well-run business and there’s no obvious reason that I can see why that past growth can’t be continued into the future.

If Rolls-Royce doubles in size will the share price double?

The company has stated that it has the potential to double revenues (and presumably earnings and dividends) in the next decade. If that were to happen, what sort of share price gain could investors expect?

The answer would depend on what the market’s expectations were…