Taking a slightly sideways view of Carillion's demise, it may have implications for the bus sector. This is an industry that is largely operated by a handful of dominant players. As of today, The First Group, Go-Ahead and Stagecoach are all heavily indebted and all are being shorted by hedge funds. This leads me on to Rotala (LSE:ROL), a very well established and profitable bus company that views the recently enacted Bus Services Act 2017 as a huge opening for its development.

Essentially, the Bus Services Act allows areas that have opted for an elected mayor to work in partnership with bus companies to improve local transport. However, those local authorities cannot set up their own bus companies. Whatever choices are made will require working with private operators such as Rotala. The Act will allow authorities to put bus routes out to tender. That is to say, to refranchise.

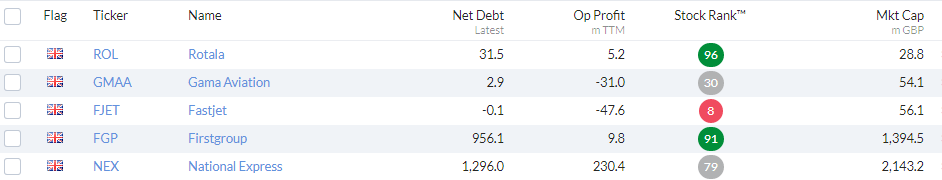

If one looks at the three main hubs operated by Rotala, those areas are dominated by the big bus companies. Combined they have a market share of some 70%. Most of these companies have considerable levels of debt and, of course, some are being shorted by hedge funds. I would suggest that in the current environment, the Government is mindful of potentially unstable suppliers of key services. The Bus Services Act may be the catalyst that Rotala has been looking for. Incidentally, I hold the stock.

It seems to have gone unnoticed that the CEO, Deputy Chairman and an NED have purchased some 186,030 Rotala (LON:ROL) shares this month. The company stands to benefit from the reforms created by the Bus Services Act 2017. It has also hedged almost all its 2018 oil demands. It's unclear whether its rivals have done the same.

The company will be presenting at a ShareSoc event at Birmingham on 1st May 2018. It could be worth closer scrutiny.