My post on Stagecoach last week reminded me of a company I remember having looked at late last year - Rotala (LON:ROL) , a small cap bus operator in the UK. It's a refreshing company, probably because its services are immediately understandable and obvious to us - the business model is relatively simple, and the economics underlying it is no great mystery either. I figured I should give Rotala another look, both since I enjoyed looking at Stagecoach and because I had one big refrain - I thought the type of business this was was probably rather prohibitive to the little guys.

My post on Stagecoach last week reminded me of a company I remember having looked at late last year - Rotala (LON:ROL) , a small cap bus operator in the UK. It's a refreshing company, probably because its services are immediately understandable and obvious to us - the business model is relatively simple, and the economics underlying it is no great mystery either. I figured I should give Rotala another look, both since I enjoyed looking at Stagecoach and because I had one big refrain - I thought the type of business this was was probably rather prohibitive to the little guys.

On that note, I found a nice report produced for the Government in 2010. These often give a feel behind the economics of an industry, and are usually pretty interesting reading. Among other things, it discusses the barriers to entry for smaller players - mostly financial and logistical, as you'd expect, and the average returns of the big 5 bus players in the UK.

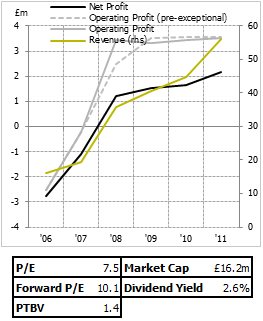

The edgeIf Rotala have an obvious advantage over their larger competitors, then, it's the growth one. The magic of free market creative destruction - or whatever you want to call it - serves to see smaller companies tending to grow significantly faster than their larger competitors over any reasonable period of time. Rotala have grown revenues by 57% over the last 3 years; though improvements in operating profit haven't quite kept up. Operating assets haven't increased by nearly as much, either. Fuel costs and a reduction in the level of Government support have contributed to the worsening margins, so the potential for reversion there is debatable. Perhaps, if fuel costs stabilise, Rotala will be able to start bumping margins back up over time.

Along with small-cap size often comes a relatively cheaper price, as well, in earnings or asset terms. This is clearly a benefit, but in some part is simply a reflection of the greater risks inherent in holding a company which isn't a huge and entrenched market player. Rotala is clearly cheaper than Stagecoch, for instance, though again I'm oversimplifying; Stagecoach have a far wider remit than Rotala does.

The downsideFrankly, though, in bus operators more than most I can see scale advantages. Transport just lends itself to size, as does the regulatory system.…

.png)