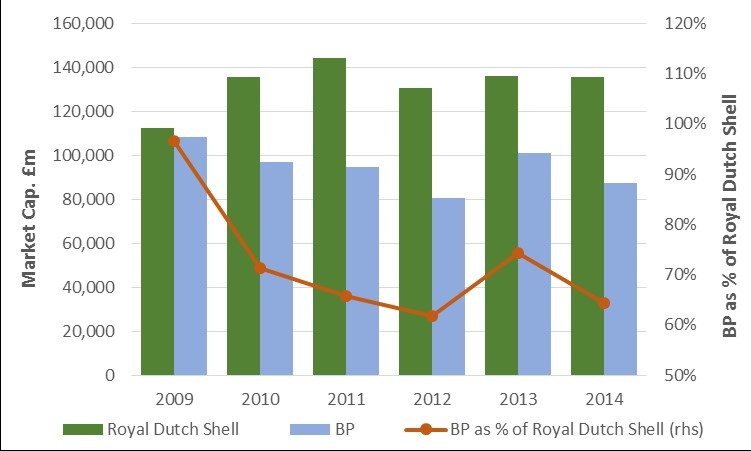

Since July, the collapse in world oil prices has been the talk of global financial markets. Brent crude oil, the global benchmark, has fallen from $115 per barrel to under $69 today, a price not seen since 2009 (Figure 1).

1: Brent Crude Oil Back to Prices Not Seen In the Last 5 Years

Source: Investing.com

This has been painful for investors holding oil and gas stocks such as Royal Dutch Shell (LON:RDSA) (RDS) or BP (LON:BP.), with Royal Dutch Shell shareholders nursing losses of 10% since June, and BP shareholders an even more painful 15% loss since June.

Merger and acquisition activity hots up in oil

There have been a number of consequences of this sharp oil price fall, one of which has been an increase in merger and acquisition activity in the global oil and gas sector.

For instance in oil services, Halliburton (HAL) is in the process of taking over US rival Baker Hughes (BHI) for $35bn. But perhaps the biggest potential takeover in this sector is still ahead of us...

Could Royal Dutch Shell buy BP?

This sounds ridiculous at first flush – after all, BP is a giant company worth over £136bn at its current 425p share price (as of 5 December). However, it is perhaps not such an outlandish notion upon reflection.

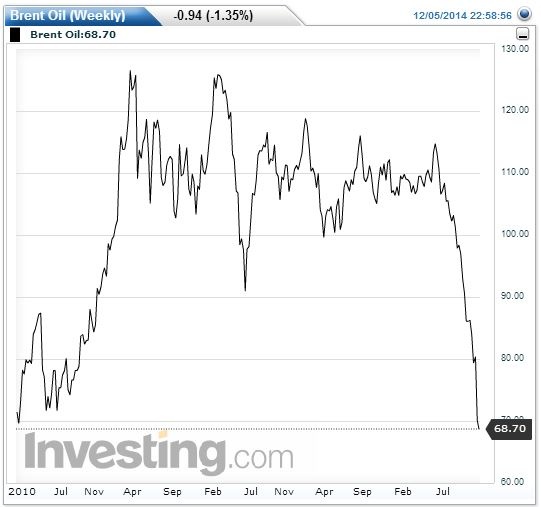

First of all, at today's 425p BP (LON:BP.) languishes some 34% below its 640p share price reached in March 2010, before the Deepwater Horizon disaster in the Gulf of Mexico took place, costing BP $27bn dollars (so far) in clean-up costs and damages.

In sharp contrast, Royal Dutch Shell (LON:RDSA) has gained 13% from 1910p in March 2010 to 2149p now (Figure 2).

2: BP and Shell Share Prices Have Gone in Different Directions Since 2010

Source: Yahoo Finance

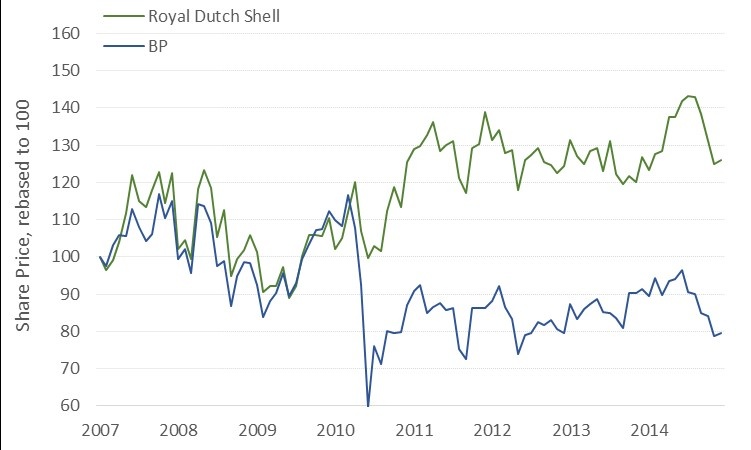

As a direct result of this widening gap in relative share price performance, BP is now only worth 64% of the total market value of Royal Dutch Shell, down from almost level pegging back at the end of 2009 (Figure 3).

3. BP's Market Capitalisation Now only 64% of Royal Dutch Shell's