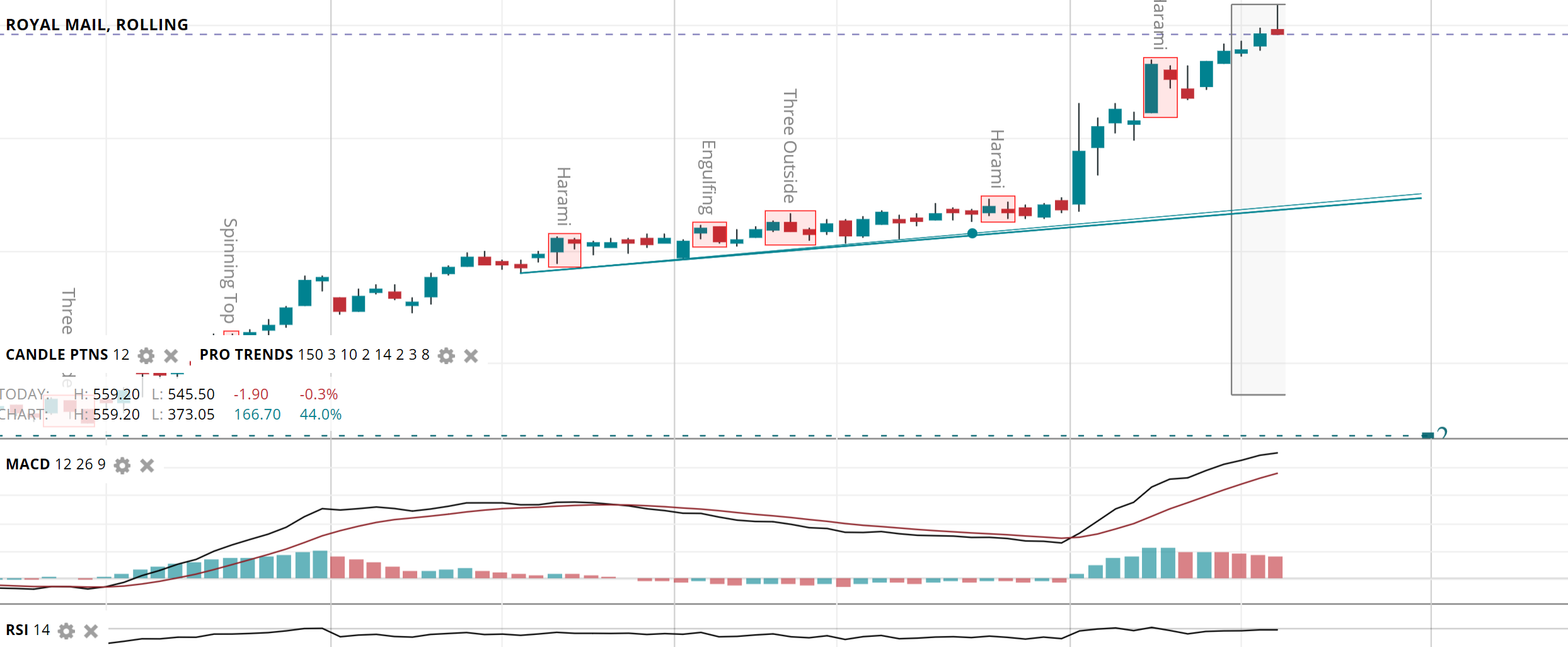

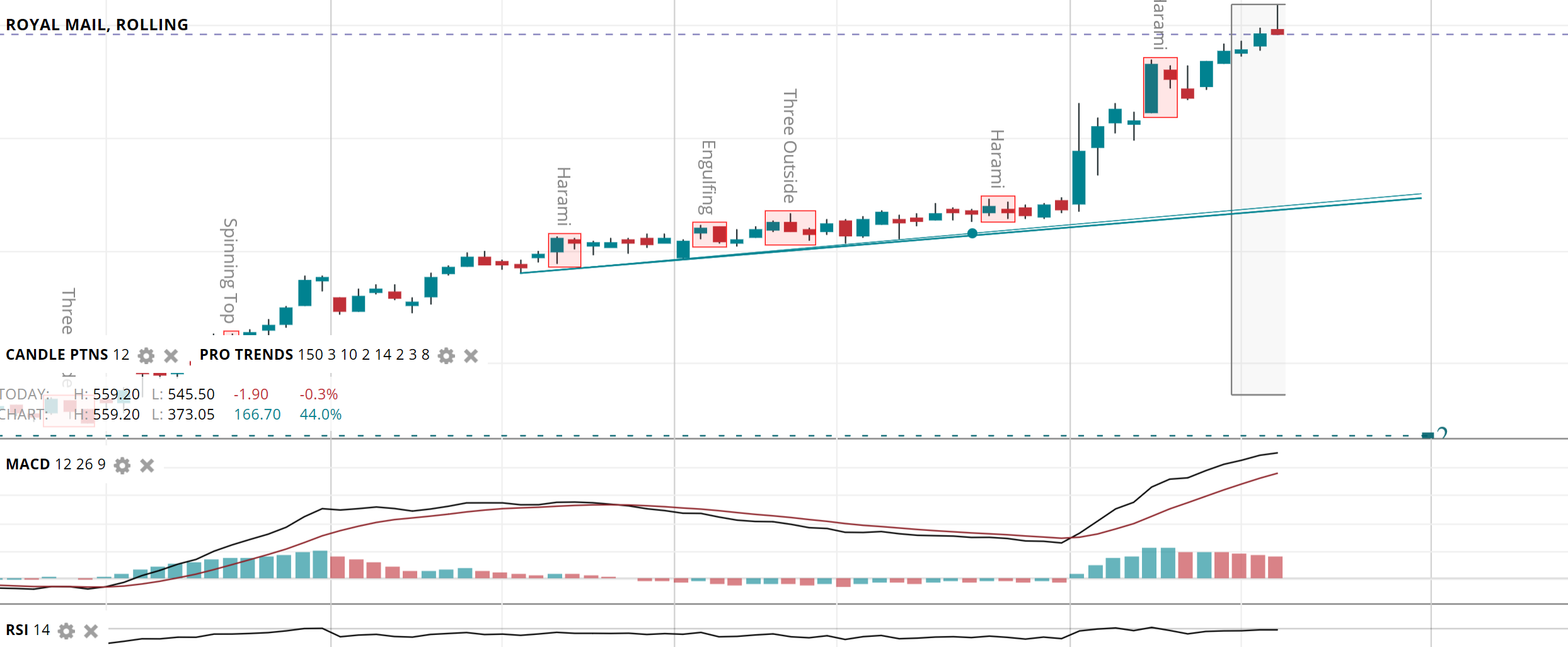

Any of the chartists here confirm the bearish hammer on the Royal mail chart today, its defo overbought, and I believe it will turn into a downtrend for a short period. anyone else have any thoughts on the chart?

Any of the chartists here confirm the bearish hammer on the Royal mail chart today, its defo overbought, and I believe it will turn into a downtrend for a short period. anyone else have any thoughts on the chart?

It's way too extended, might make a good short candidate back to the 50 day ma. Not a qualified chartist by any means though

up to a week is my timeframe. I just think the sp has got way to extended up north and might make a good short opportunity for the short duration, back down to possibly at least 500p?

I don't have thoughts on any chart, but is there any valuation based case for buying this stock ?

It's only a little hammer down. The general trend is up as can be seen by the 2 positive MA's on your chart.The MACD is still in positive territory and Stocopedia has momentum @ 98 with all green lights showing in the momentum section. If at some stage there is an engulfing ted candle,showing then watch out!

Not sure what the 2 MA'S on your chart are but you can tighten them to 5 & 8 day MA, and when those two cross over, again, it's time to get out. Raise your stop loss up a bit to safeguard profits.

Hammers are usually bullish reversal signals, appearing at trend bottoms. Don't think there is such a thing as a 'bearish hammer' (they get called by other names) but I get your drift. It is a bearish signal.

Only thing is, you must have taken the image of your chart before the day's trading closed, as that's not what's showing on Friday's close. It doesn't exist anymore. What I'm currently seeing is virtually a Doji but with the candlestick preceeding it, becomes a Bearish Harami Cross, pattern. Still bearish but if it is a Bearish Harami Cross (not 100% sure; could be a good ol' fashioned Doji, plain and simple) then it's of only moderate bearishness.

Another thing to take into consideration in these current days of volatility (led by Wall Street's troubles) is to establish if the market is buillish or bearish. It was bullish before the past week or so. Remains to be seen if that remains the case in coming weeks/months, but usually in a bearish market, exit signals at the top of an uptrend get put on steroids, and strong bullish reversal signals at the bottom of a trend become weaker. ie., all company bad news in a bear market get punished heavily and vica versa with all good news in a bearish market being virtually ignored. Officially we are not in a bearish market yet, so if it is a Bearish Harami Cross then it is of only moderate bearish strength.

PS. Almost forgot - Yes, agree, It is also very Overbought, and has been in overbought condition since the very beginning of February, furthmore most indicators and oscillators back up the overbought condition; so I believe the SP may unravel somewhat in the coming week/s.

It's in a very, very, strong, admirable uptrend, so is not looking to willingly give up that bull trend so easily, it's been very strong indeed, but with so many indicators in agreement with the latest candlestick pattern, also supporting an overbought condition, it all suggests to me, that beautiful uptrend may be about to get it's hair ruffled a bit.

Any updated views on this stock? Brokers seem to agree to sell so its probably a buy then:=)

I'm waiting at least another quarter for the results of their cost-savings initiative. Seems like it will disappoint again.