Rule 1: Never loose money

I was wondering about this famed Buffet quote and how negative returns can impact a portfolio over say 10 years. The maths is fairly simple that a 50% downturn requires a 100% upturn to break even and this in itself is quite worrying!

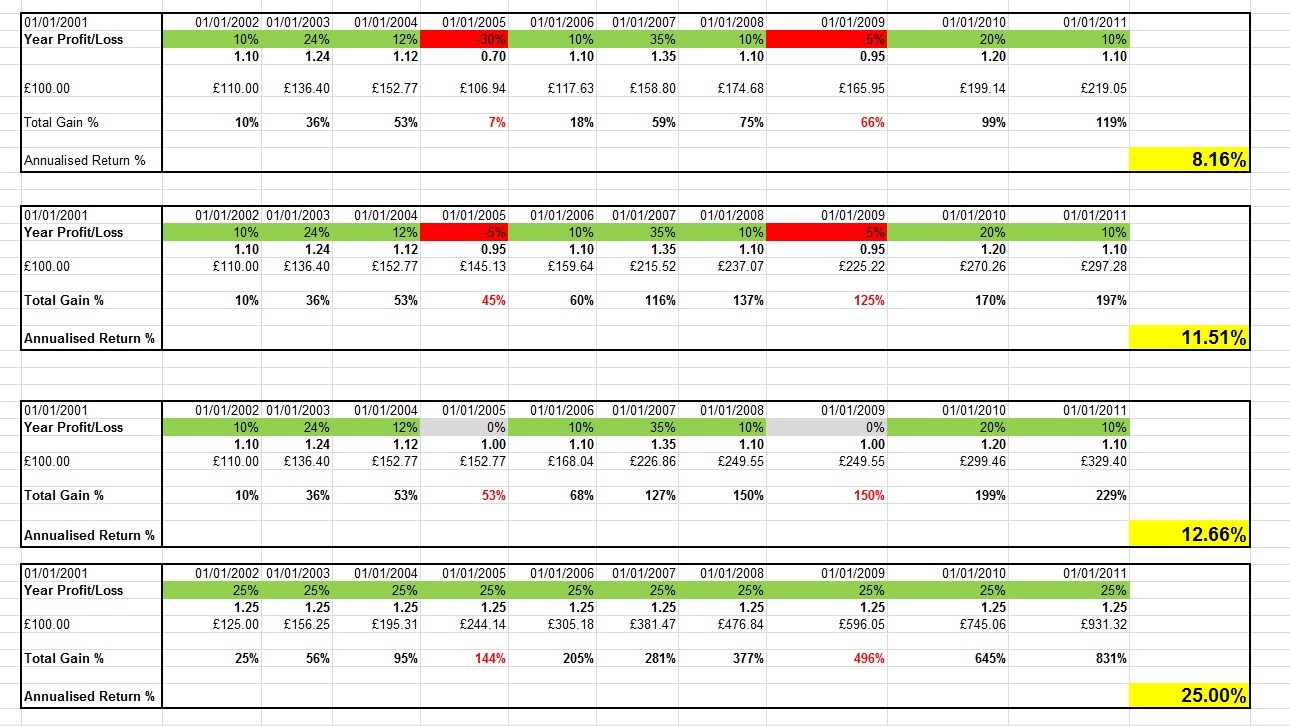

So i've done a very basic illustration below ( i believe its accurate..) of how a couple of bad years/ crashes can hamper your annualised returns. Now obviously the yearly returns are just made up and you could say some are unlikely ( but who knows from last years naps!?), and theres a million different combinations you can explore. But still, it helps illustrate a point, it also illustrates how a couple of percentage points extra in annualised returns can substantially alter the total return over a period of time.

Now I'm sure most people on here are more than aware of the maths and aware of what returns can do to the long term picture, but for a relatively inexperienced investor like myself, it helps hammer home what lack of diversification, risk management, research or selling rules could do to returns over the long run.

If anyone has any links to better/ proper charts or analysis of this I would be interested to hear!

ps..obviously I'm aiming for the last table......