This week’s article is based on a recent subscriber suggestion that I might try to screen for cyclical sectors that could be about to turn up.

This was an interesting challenge. While I did find one sector where I believe there’s evidence of widespread value and opportunity, I also found a range of cyclically-depressed individual stocks that I think could have significant turnaround potential.

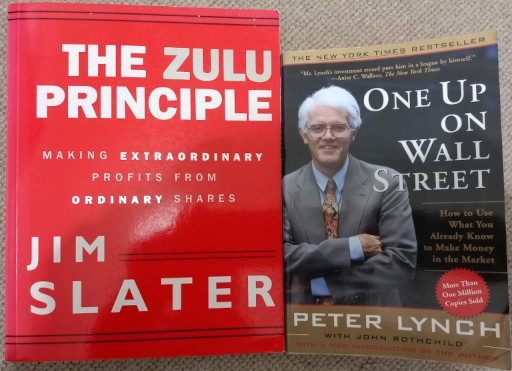

According to legendary investor Jim Slater, I shouldn’t have been surprised by this. In his classic book on growth investing, The Zulu Principle, Slater says:

Turnarounds are not far removed from cyclicals and asset situations … a badly-managed cyclical often becomes a turnaround at the bottom of the cycle

In One Up On Wall Street, legendary fund manager Peter Lynch says much the same thing about turnarounds (discussing Chrysler in the 1970s/80s):

These aren’t cyclicals that rebound; these are potential fatalities … A poorly managed cyclical is always a potential candidate for the kind of trouble that befell Chrysler.

Both Slater and Lynch stress that timing is critical with these investments. Share price swings of +/-50% from peak to trough are not unusual and profit swings can be even greater.

Get it wrong and you can spend years waiting for a real upturn to (hopefully) rescue your investment. For this reason, both men emphasised that having an informational edge is often one of the few ways to get an advantage in these types of situations.

Lynch also cautions us to recognise the true nature of these businesses:

Cyclicals are the most misunderstood of all the types of stocks … because the major cyclicals are large and well-known companies, they are naturally lumped together with the trusty stalwarts

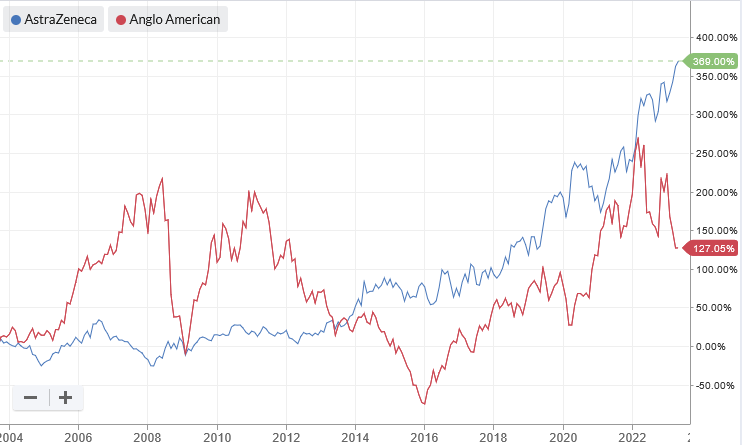

However, we need to remember that these businesses perform very differently. Consider this share price chart showing FTSE 100 pharmaceutical group AstraZeneca (LON:AZN) and miner Anglo American (LON:AAL) over the last 20 years:

I read One Up On Wall Street and The Zulu Principle many years ago, and revisited them for help with the construction of this screen. Both books are well written, entertaining and packed full of timeless investing wisdom. I would highly recommend them, whatever your style of investing.

Building the screen

Let’s…