In September of last year, Nick Train of Lindsell Train commented in his UK Equity Fund report to shareholders:

“Broadly September in the UK stock market saw a sell-off in international “growth” stocks – after an amazing run, lasting years in some cases - and a rally in domestic “value” stocks.

More recently, an article written by Mark Donovan of Boston Partners and published on Robeco’s website caught my eye. In it, Donovan argues the case for a resurgence in value investing and points to a “subtle change in factor leadership towards value metrics.” He claims that all of the 31.5% gain in the S&P 500 last year came from multiple expansion and that “the last time such a multiple-fueled rally occurred in 1991 and 1998, it triggered periods in which value stocks outperformed for many years.”

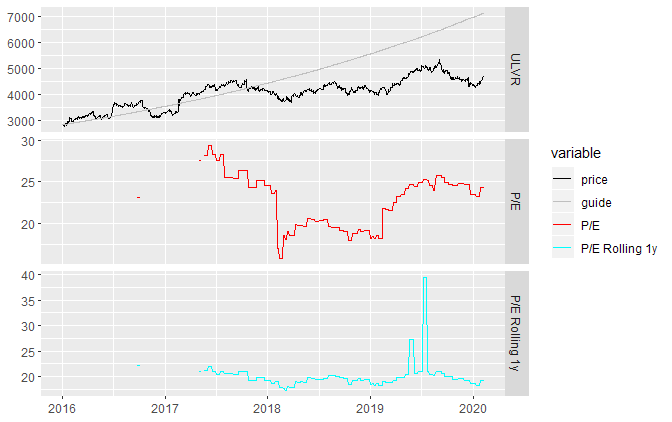

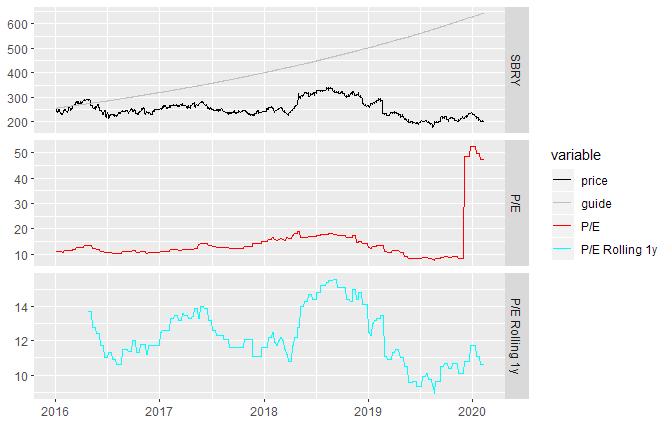

I’ve seen similar comments from various sources in recent months. Certainly, there are high margin quality companies today that generate lots of free cash flow but look expensive - Unilever (LON:ULVR) for example - and low margin, capital intensive value shares that look cheap, such as J Sainsbury (LON:SBRY) .

But if we take the share price performance of those two companies over since 2015, we see a startling divergence in performance.

As of early February 2015

Name | Forecast PE | ROCE | Value Rank | Quality Rank | Share price (p) |

Unilever | 20.8 | 28.1 | 34 | 80 | 2,802 |

Sainsbury’s | 11.3 | 2.97 | 91 | 37 | 262.9 |

As of 11th February 2020

Name | Forecast PE | ROCE | Value Rank | Quality Rank | Share price (p) | Share price change |

Unilever | 20.1 | 19.9 | 31 | 83 | 4,689 | +67% |

Sainsbury’s | 10.3 | 3.2 | 81 | 13 | 202 | -23% |

Throughout this period, Unilever has remained much more expensive based on relative valuation ratios. Its ability to consistently generate high returns on capital shows it to be a much more valuable company, however. The longer you leave it, the more pronounced this effect becomes.

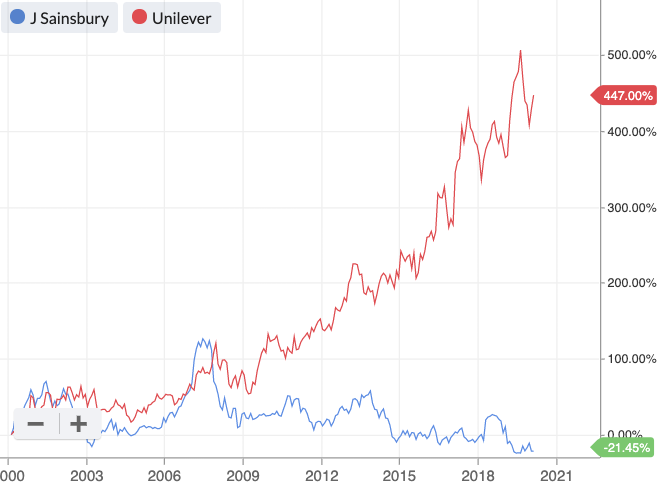

If you look at the two companies’ share price performances side by side over two decades, the results are even more striking:

Of course, these are just two stocks and any other two might tell a different story. It’s still a powerful illustration of the perks of long term quality investing.

Markets are not perfect but neither are they completely inefficient. Most stocks with cheap valuations are priced that way because they are poor businesses. Conversely, some superficially expensive stocks are in fact cheap if you think of intrinsic value as the sum of future discounted cash flows.

It makes sense then, when Buffett says “time is the friend…

.jpg)