This week I’m looking at a topic close to my heart – finding companies that can provide a sustainable, growing, dividend income.

A portfolio of such shares has the potential to provide a reliable passive income, with minimal trading. Over long periods, sustainable dividend growth tends to reflect underlying business growth, and should also lead to share price growth.

This means that with dividends reinvested, a dividend growth strategy can also be a good way to generate long-term compound gains.

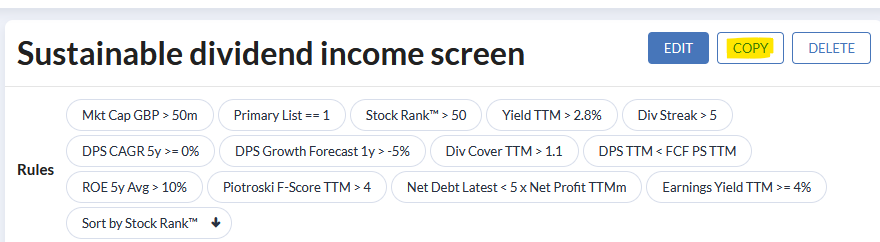

In pursuit of a systematic approach to finding sustainable income, I’ve built a new screen to try and capture what I believe are the essential qualities of a good dividend.

I should point out straight away that this screen will probably exclude some suitable stocks and include some unsuitable choices. That’s okay with me. Indeed, I think it’s to be expected.

As with the StockRanks, the purpose of a screen isn’t to achieve a 100% success rate. That’s not realistic. Instead, we want to swing the odds in our favour by selecting a statistically favourable group of shares. I think I’ve been able to do that here, as I’ll explain.

Sustainable income screen criteria

In this section, I’ve split up the rules I’ve created into different categories and tried to explain why I think they’re important.

I’ve linked to my sustainable dividend income screen here.

Which companies?

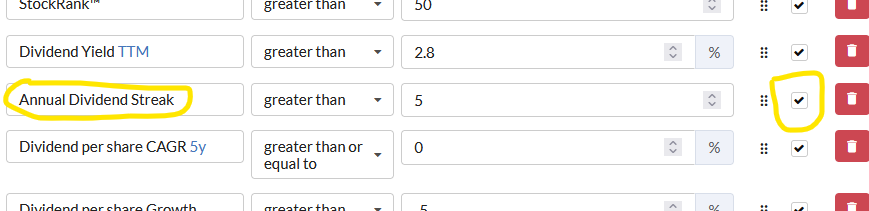

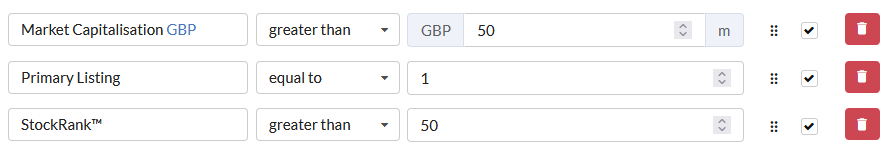

To start with, I created three simple rules to filter out stocks that are statistically unlikely to offer the kind of qualities I’m looking for.

First of all, I don’t want any micro caps or foreign shares. These may sometimes have attractive income qualities. But they can be riskier and will require too much in-depth research for this strategy.

I’ve also specified a minimum StockRank in order to exclude shares that are statistically less likely to perform well. This might exclude some good businesses, but as a group, we know that companies with low StockRanks have underperformed over the last decade.

Rule #1: Market cap > £50m

Rule #2: Primary listing ==1

Rule #3: StockRank > 50

Here’s how this looks in the screener:

Dividend metrics

Sustainable income is about company culture as well as financial performance. What I want, ideally, is to…