In a recent discussion with other Stockopedia writers, Megan mentioned that Value-Momentum had been the best-performing strategy in the Stockopedia database. I was initially a bit confused. We typically refer to such stocks as Turnarounds. However, when I look at the long-term performance of the Turnaround StockRank Style stocks, they aren’t particularly great:

The clue to this mystery is in how few Turnaround Stocks there are:

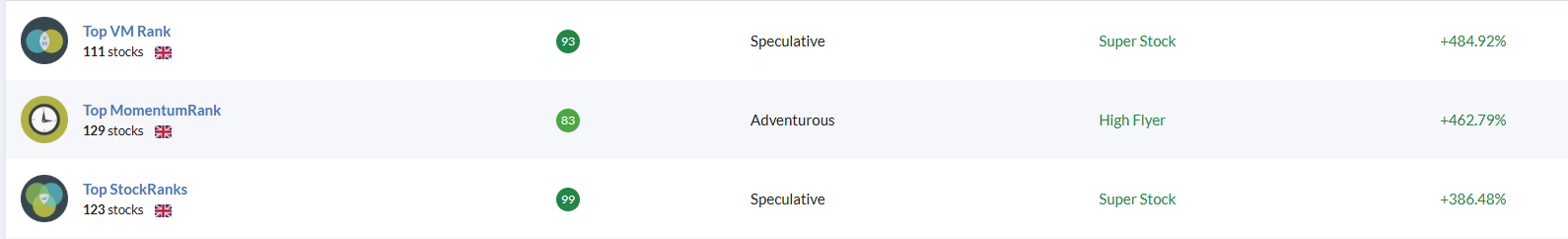

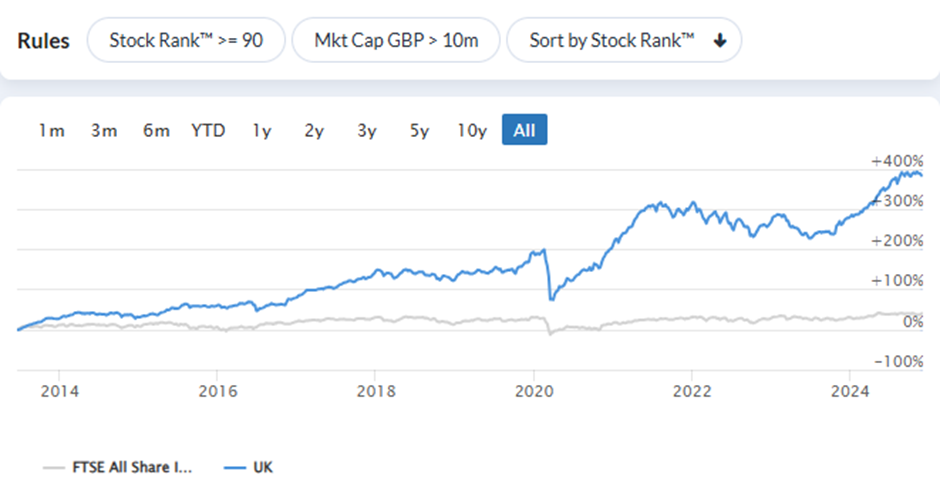

What is happening is that this StockRank Style is excluding SuperStocks, those that also have a high Quality Rank. When we ignore the Quality Rank and just look at the highest combined VM Rank the results are completely different:

This makes sense. Turnaround investors will be looking for cheap companies that have started to show signs of outperformance but that the market hasn’t fully priced in that yet. Such companies may have yet to show high returns on capital, and improving prospects may not yet have appeared in all the financial metrics. However, there is no reason to exclude companies where this has happened (and hence, the Quality Rank is high), yet they are still modestly priced.

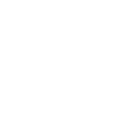

The high-VM Rank even beats the pure QVM StockRank Strategy:

I think it is worth considering why this may be the case. Firstly, this could simply be by chance. However, looking at the graphs, the outperformance of the high VM stocks appears to be because they don’t drop as much in difficult years. The VM strategy outperforms in 2018, 2020 and 2023 (although it doesn’t completely escape the carnage of the COVID sell-off). This could be very useful for investors because down-years are much more likely to cause investors to switch strategies unnecessarily. It seems that by demanding high VM, the strategy avoids stocks that are superstocks mainly because of their Quality-Momentum characteristics. These may be great performers a lot of the time but are susceptible to rapid reversals during weak markets.

Screening for Turnarounds

Knowing this may well be a great investing strategy, I can build a screen to find potentially interesting investments that have strong VM characteristics at the moment:

In addition to this, I have added a couple of criteria that I think…