In last week's article, I looked at the first set of companies that were identified by my earnings-based stock screen and found four companies that made it onto my watchlist: James Latham (LON:LTHM) Quarto (LON:QRT) Zytronic (LON:ZYT) £GLE.

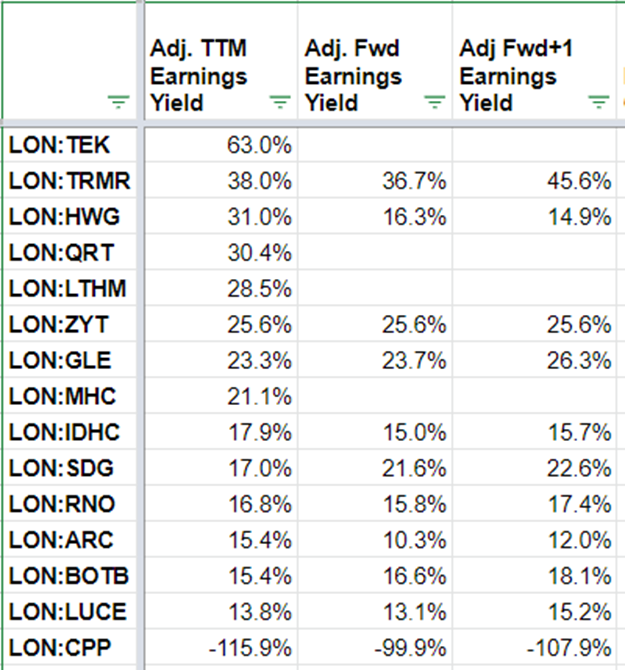

This week I will be looking at the remaining eight non-resource stocks. But before I do that, it is worth revisiting the adjusted earnings yield figures. This is because that past week has featured a period of market volatility, so prices may well have altered significantly:

The other adjustment worth considering is where significant acquisitions have been made or dividends and buybacks enacted since the balance sheet date. One example is Tremor International (LON:TRMR) which acquired Amobee, post the last balance sheet date. Here the company says:

The Acquisition consideration of $239 million, as adjusted, was funded through a combination of existing cash resources, and approximately $100 million from a new $180 million secured credit facility. The new credit facility consists of a $90 million secured Term Loan A drawn at closing, and a $90 million Revolving Credit Facility, of which $10 million was drawn at closing.

This means that I increased long-term debt by $90m, short-term debt by $10m and reduced the cash balance by $139m compared to the balance sheet figures. I also estimated the impact of the buyback since the period end.

I don't tend to make adjustments for a small dividend payment or a modest ongoing share buyback, but when significant capital is returned, it is worth updating the balance sheet for this impact. For example, Best Of The Best (LON:BOTB) conducted a tender offer where they bought back 1,045,877 Ordinary Shares at 600 pence per Ordinary Share, for a total consideration of £6,275,262 after their last balance sheet date on 30 April. This has the effect of reducing both the share count and the cash balance by these amounts. In the figures above, I have adjusted for these major transactions.

Now onto the remaining non-resource companies:

Myhealthchecked (LON:MHC)

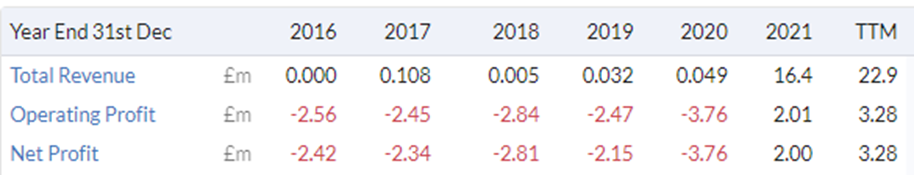

MyHealthChecked develops and sells at-home diagnostic tests. The sort of revenue & profit growth they have recently generated looks impressive:

…until you realise that they have been providing COVID travel tests. This market will likely disappear entirely in the near term, if it…