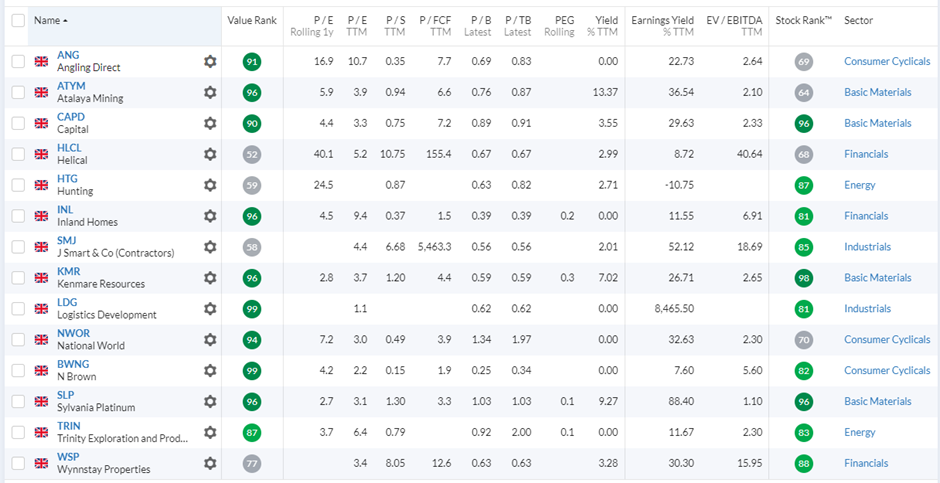

Over the past few weeks, I have used the Stockopedia screening tools to identify attractive value investing portfolio candidates. Using the Stockopedia StockReports, I quickly excluded companies with more obvious issues that made them uninvestable. I then conducted a more detailed initial analysis, and those that passed this test made it onto my watchlist:

But what next? How does a watchlist candidate end up as a portfolio position? For value investors, there are two key considerations: how much research is enough? And when is the right time to buy a value stock?

How much research should an investor do?

This is a surprisingly complex question. It can be tempting to think that the more research an investor does, the better. However, the relationship between information and accuracy of judgement is less straightforward than expected. The problem is not just in the time taken to do the extra research but the power that increasing knowledge has to make us overconfident.

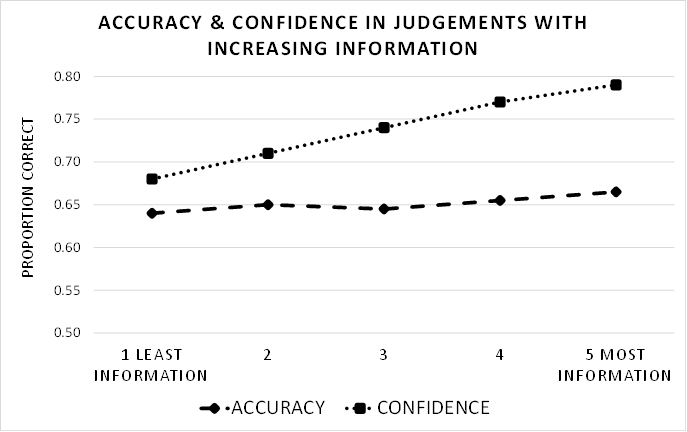

Several studies have shown that, beyond a relatively basic level of understanding, increased knowledge does very little to improve our accuracy. For example, In 2008, Tsai, Klayman, and Hastie tested how additional information improved an individual’s ability to predict the results of US college football games from anonymised statistical information. Surprisingly, they found that each extra set of information didn’t do much to improve the accuracy of the predictions (the dashed line below):

However, that extra knowledge greatly enhanced participants’ confidence in their predictions (the dotted line). It is this increasing overconfidence that makes knowledge-based judgement so difficult. This same result has been found in other studies, including one done as far back as 1951, so this effect is likely to be pervasive enough to affect our investing judgment too. Being overconfident will negatively impact our returns sooner or later.

Because of this effect, investors may not need to do any further research before choosing to buy a value stock. Several value investing strategies use what is known as “strategic ignorance”: researching a stock to a defined level and refusing to go beyond that. Indeed, Stockopedia’s founder Ed Page-Croft uses this in generating his NAPS portfolio. He uses the StockRanks alone to generate his picks, knowing that they are based on academic research into factors that tend to outperform the market.

However, Ed also uses something…