In the wild months of March and April, plenty of stocks became cheap as markets tanked. There has since been a recovery - but there are still some attractive valuations out there.

One recent example was Gear4music, which repeatedly flagged improving profitability to the market and has just this past week shot up to above the 400p level - so congratulations to any holders out there.

We looked at it here and here. At current levels it feels like the easy money has been made for now. I reckon there are plenty more fish in the sea though - perhaps even in G4M’s own backyard: the Specialty Retailers industry group.

Some simple checks suggest that true long term quality is lacking in this small part of the market though. Of the 38 or so listed Specialty Retailers only three of those companies have managed to consecutively grow earnings for more than the past three years (take a bow Boohoo, JD Sports, and ScS).

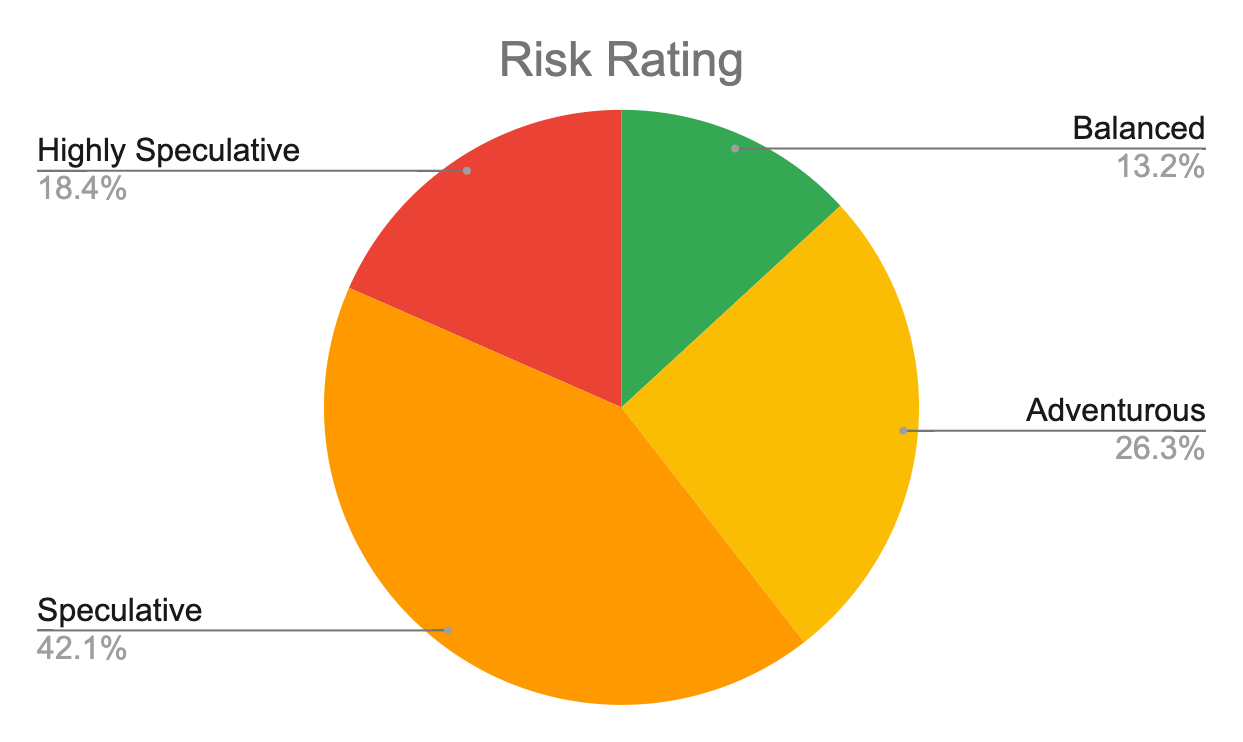

It’s a volatile set, with over 60% of the stocks classed as either Speculative or Highly Speculative.

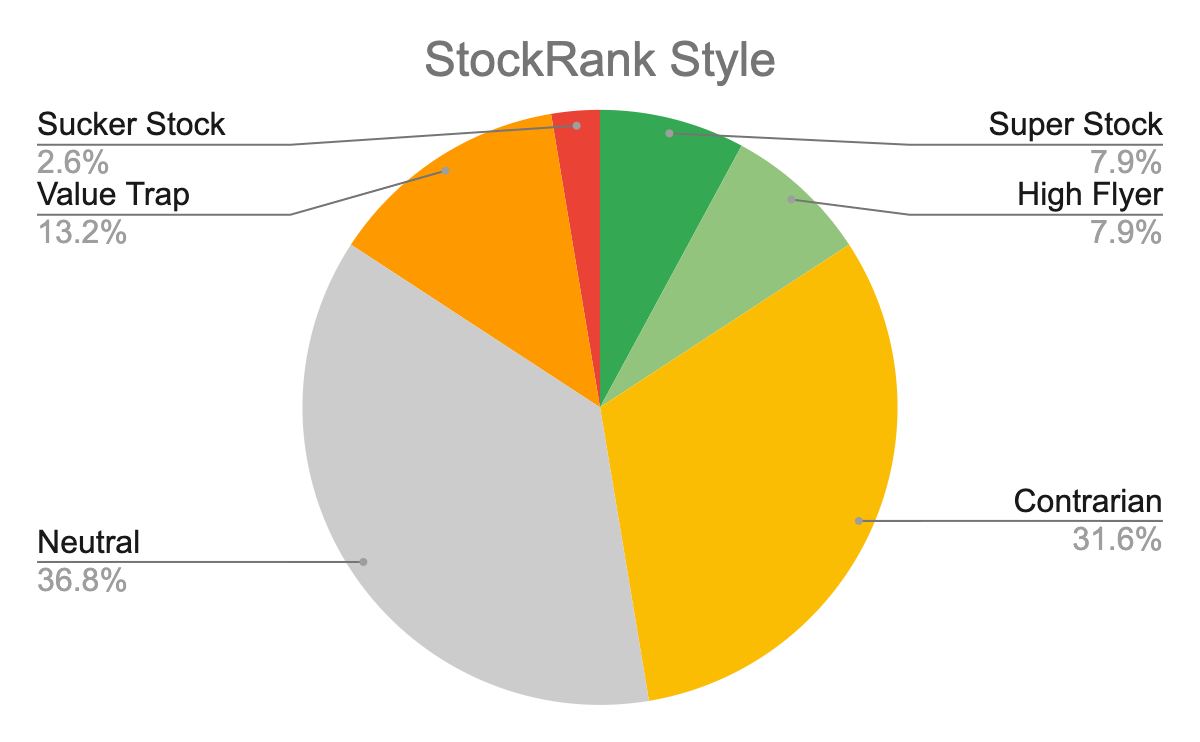

The Styles also paint a lukewarm picture, with the largest segment being neutral:

The above is telling me to be quite cautious - clearly, there is plenty of potential to lose money here. In fact, if you look at some quality metrics on a market-cap-weighted basis, it becomes clear that we should beware downside risk.

Large + Mid | Small + Micro | |

Quality Rank | 82.85 | 59.12 |

Long term ROCE | 24.14 | 14.79 |

F-Score | 5.73 | 4.93 |

Z-Score | 5.88 | 1.59 |

Specialty Retailers appears to very much be a group of two halves, with investment risk pooling lower down the market cap chain. True, smaller companies are usually riskier… But I still think in this instance the difference is striking, with the drop in Z-Score a particular concern.

A well-regarded fund manager once said: “When I analysed the stocks that have lost me the most money, about two-thirds of the time it was due to weak balance sheets.” If limiting downside risk is a key part of outperformance, then paying attention to these safety scores must be useful.

That said, the combination of cheap shares, strong trading and improving margins was enough to make G4M treble in…

.jpg)