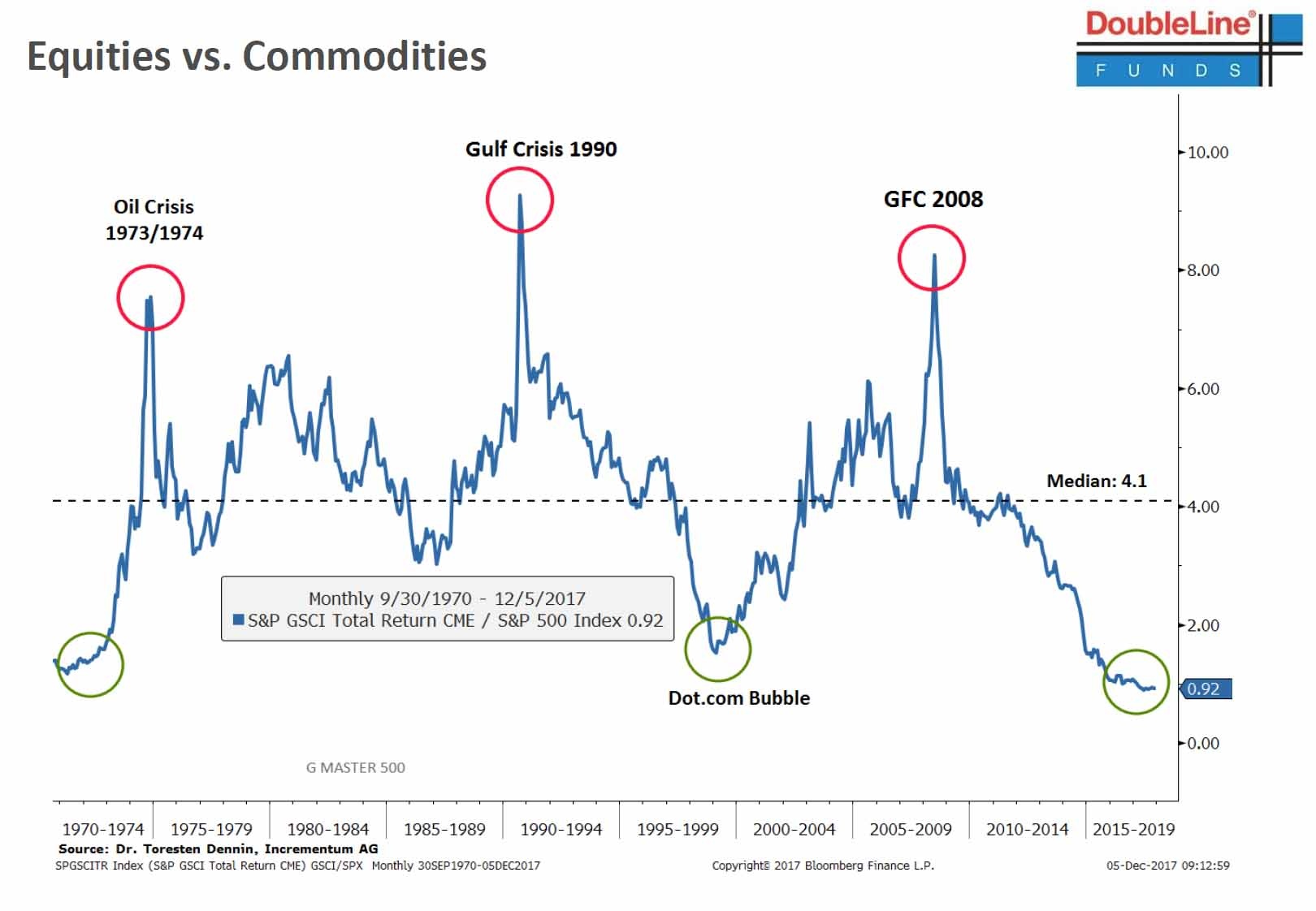

Jeffrey Gundlach, founder of Double Line, was on CNBC in an hour long interview last week and this was his best idea for 2018. He is one hedge fund manager whose views I have great respect for.

Rather than buy individual materials he suggested an ETF, I think it was Goldman Sachs's but I can't remember. I have decided to buy into this but would welcome ideas on the best ETF.

Gundlach's idea was targetted at a USA audience and if you believe sterling will weaken against the dollar next year we in the UK may derive a nice little bonus bearing in mind commodities are priced in dollars.