What a six months it's been for the NAPS Portfolio - the "bold bets on Big Mo" that I described at the start of the year have paid off. I'll go into the performance in detail shortly, but the portfolio has rocketed by 160% since the Covid crisis lows and has managed a 68% return in the last 12 months alone.

A NAPS recap...

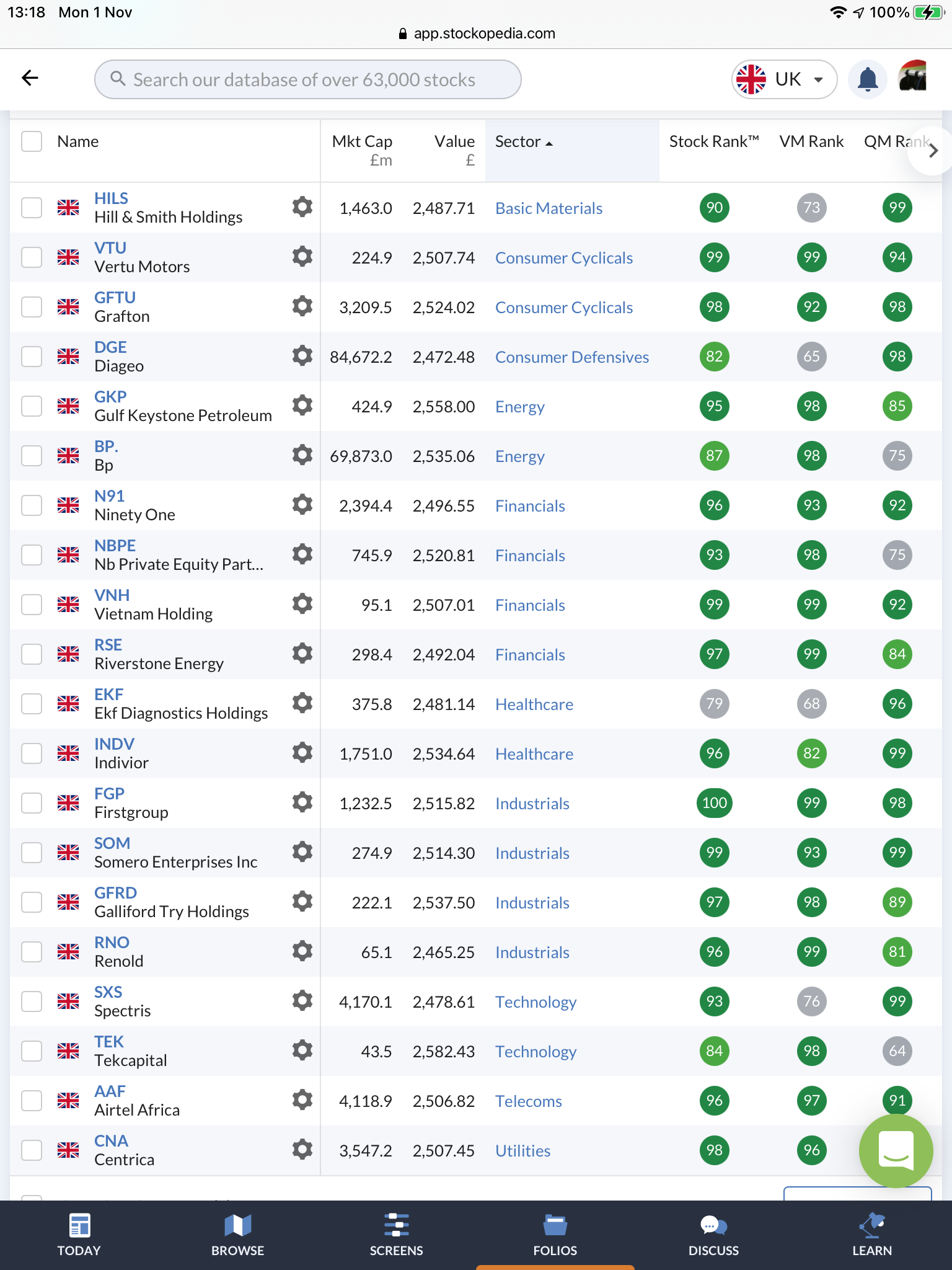

For new readers - the "no admin portfolio system" has been running since the beginning of 2015. It's a very simple, systematic process that selects the top ranked shares in each sector into a 20-stock portfolio. I run the process once per year at the start of the year, and then rebalance a year later. The "SNAPS" are the same process but run at the half-year mark.

For the first five years I used our marquee StockRank as the core ranking at the heart of the portfolio and selected 2 stocks from each of our 10 sectors. Eventually I reduced the shares held in the Utilities and Telecoms sector to one each - as frankly they tend to be small sectors with large, defensive, regulated stocks that don't hold out much hope of strong capital returns.

After five years I switched to using a "half and half" portfolio that more aligned with my market interest areas. Half the portfolio now uses the "VM Rank" (value and momentum) while the other half uses the "QM Rank" (quality and momentum). I explained the current process in depth at the start of this year - but in essence it still allocates fairly equally across the 10 sectors. I believe this change in process has added considerably to the 75% investment return the portfolio has generated in the last 18 months.

If you want to read the full history of the NAPS you can find the archive of blog posts here and some webinars about the process on our Youtube Channel.

Portfolio Performance

The performance tracking has been made much easier by the release of the great new portfolio performance tools on the site - if you aren't yet using the portfolio tracker now is the time to start. Accurate time-weighted returns are now calculated without any effort.

31% performance year to date, which compares favourably against the FTSE All Share which is up only 7.8%,…