It’s one of those years. The market has had one of its worst starts to the year in history. The excesses of the last few years need to purge their way through the system. Perhaps, if you listen to the bears, the excesses of the last few decades need to purge their way through the system. Of course, I listen to bears far too much as I have a fatalistic attraction to doom. But in my experience bears do need to hibernate regularly and will only go back into their cave when they get bored… so don’t encourage them!

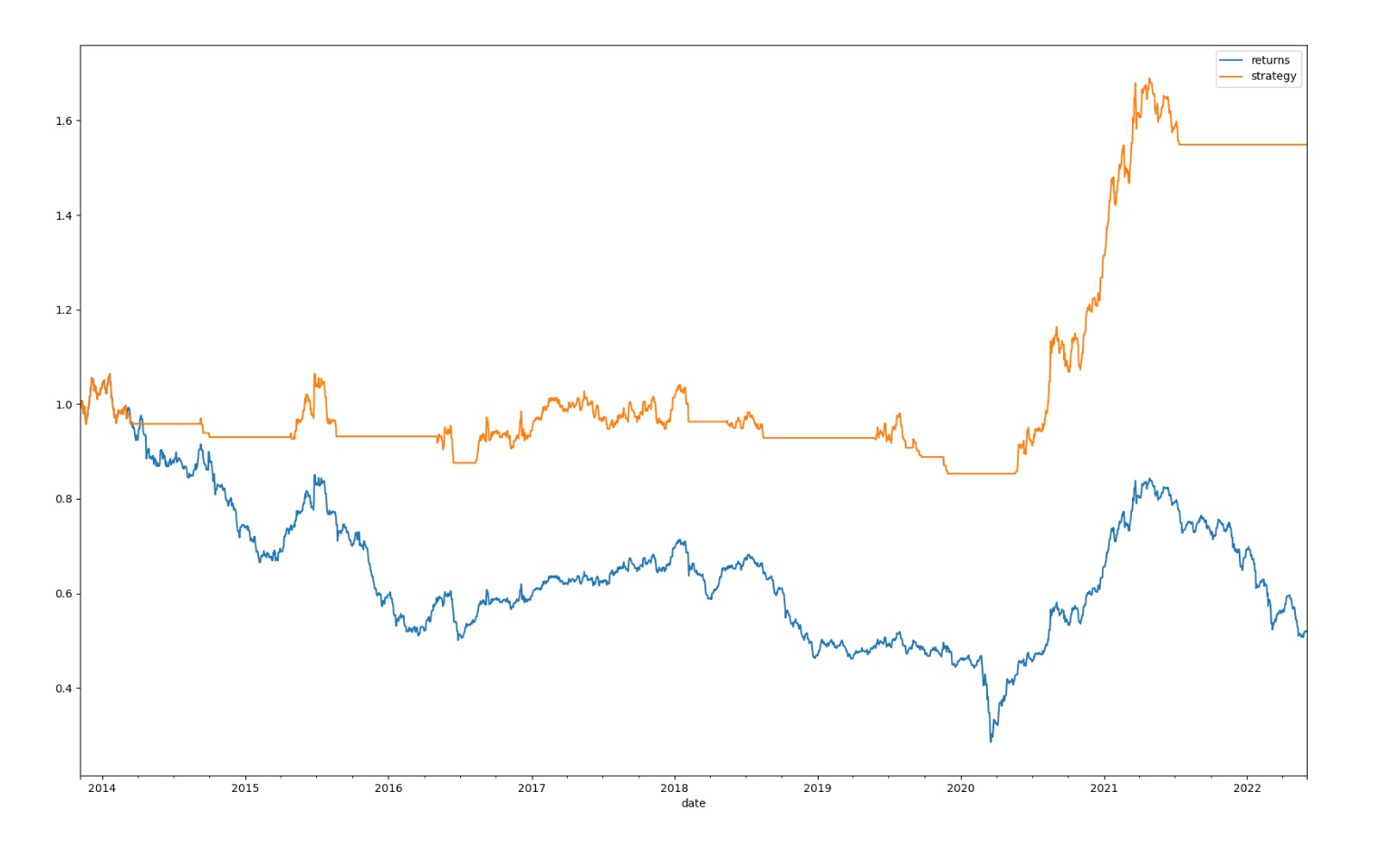

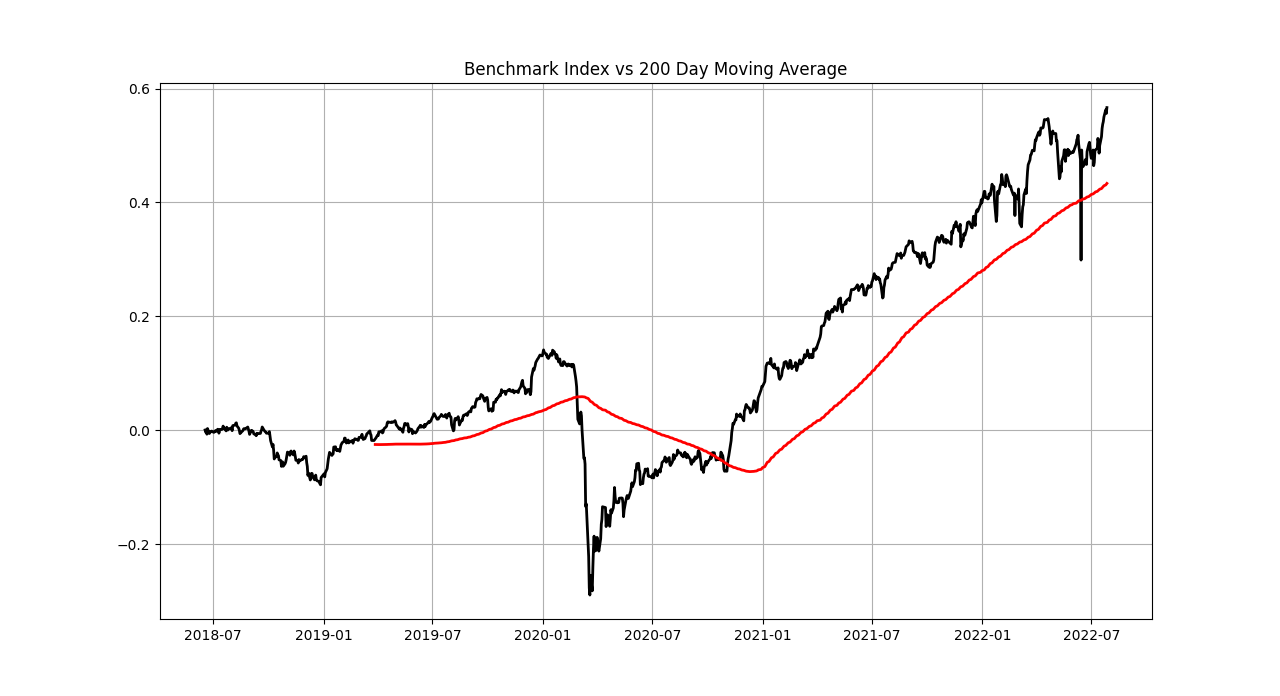

Nonetheless, after a wonderful 2021 +28%, the NAPS Portfolio (my “no admin portfolio system”) is having a reversal, with a -16% fall year to date, closing for the half at a low for the year. It’s well behind the FTSE All Share which held up rather well due to its heavy loading on value sectors. Of course the NAPS is significantly outperforming the FTSE AIM All Share which is down 28% year to date - which may be more reflective of many private investor portfolios given their AIM bias.

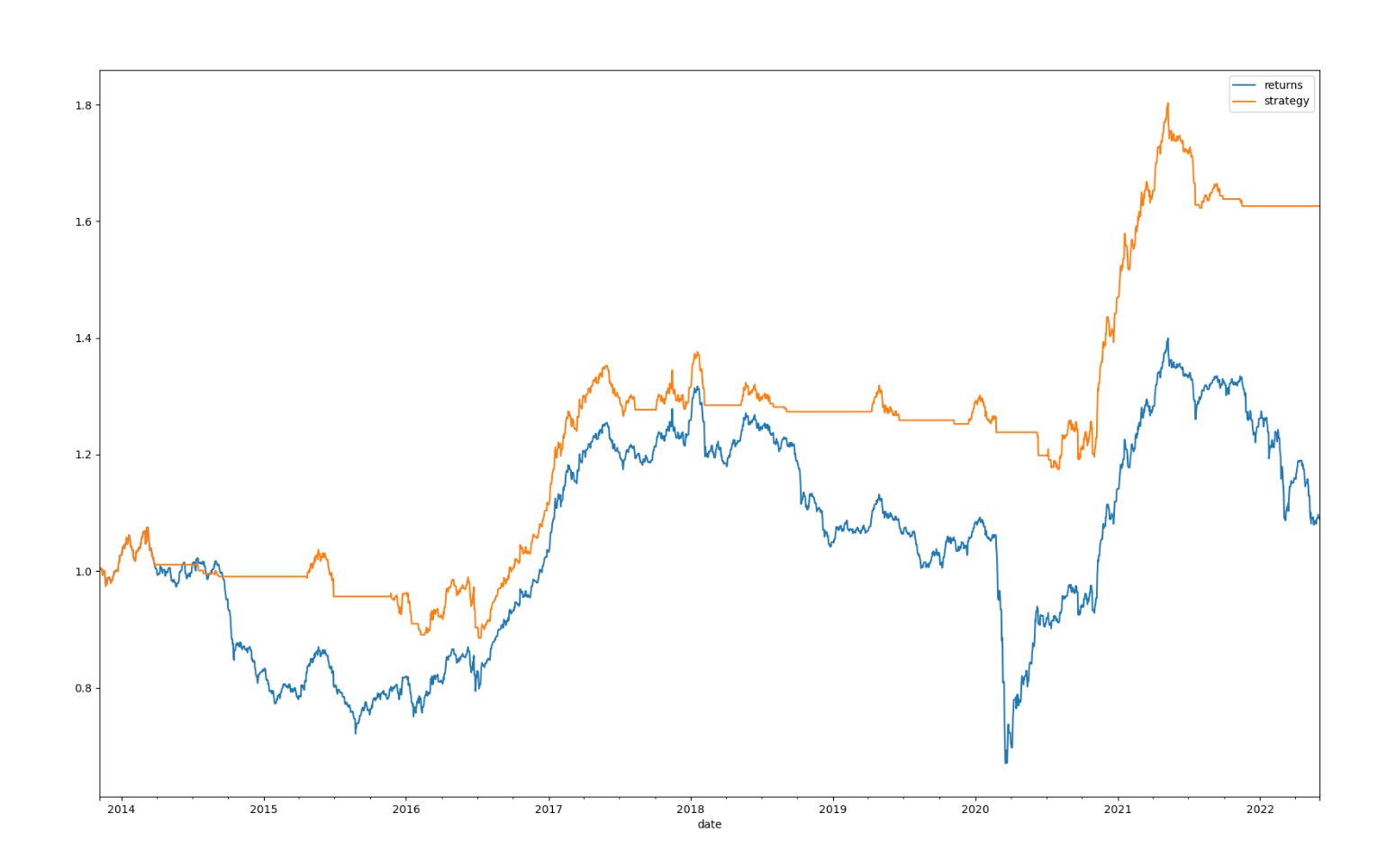

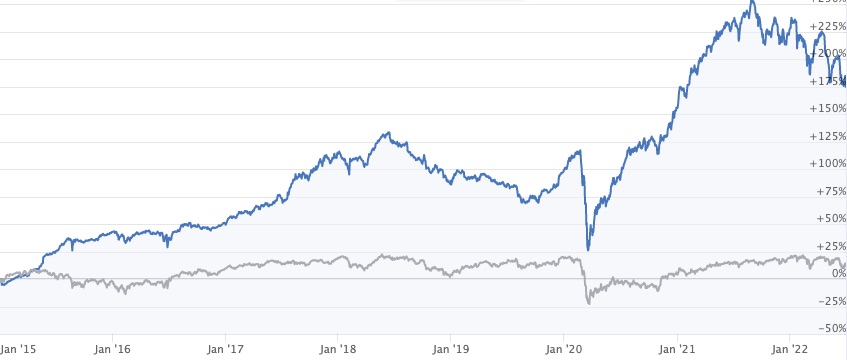

The long run returns look a bit leaner now than at the start of the year, but still up a handsome 14.5% annualised or 175% (before dividends & transaction costs) and beating the FTSE All Share pretty convincingly.

If you compare the performance of the NAPS against the 247 Funds & Unit Trusts in the IA All Companies Sector - it would lie in fourth place over the last 5 years. That’s in the 98th Percentile of performance. Given the NAPS takes an hour per year to manage, but those other 243 Funds & Unit Trusts seem to take full time management by teams of expensive fund managers - it does make you wonder what they do all day.

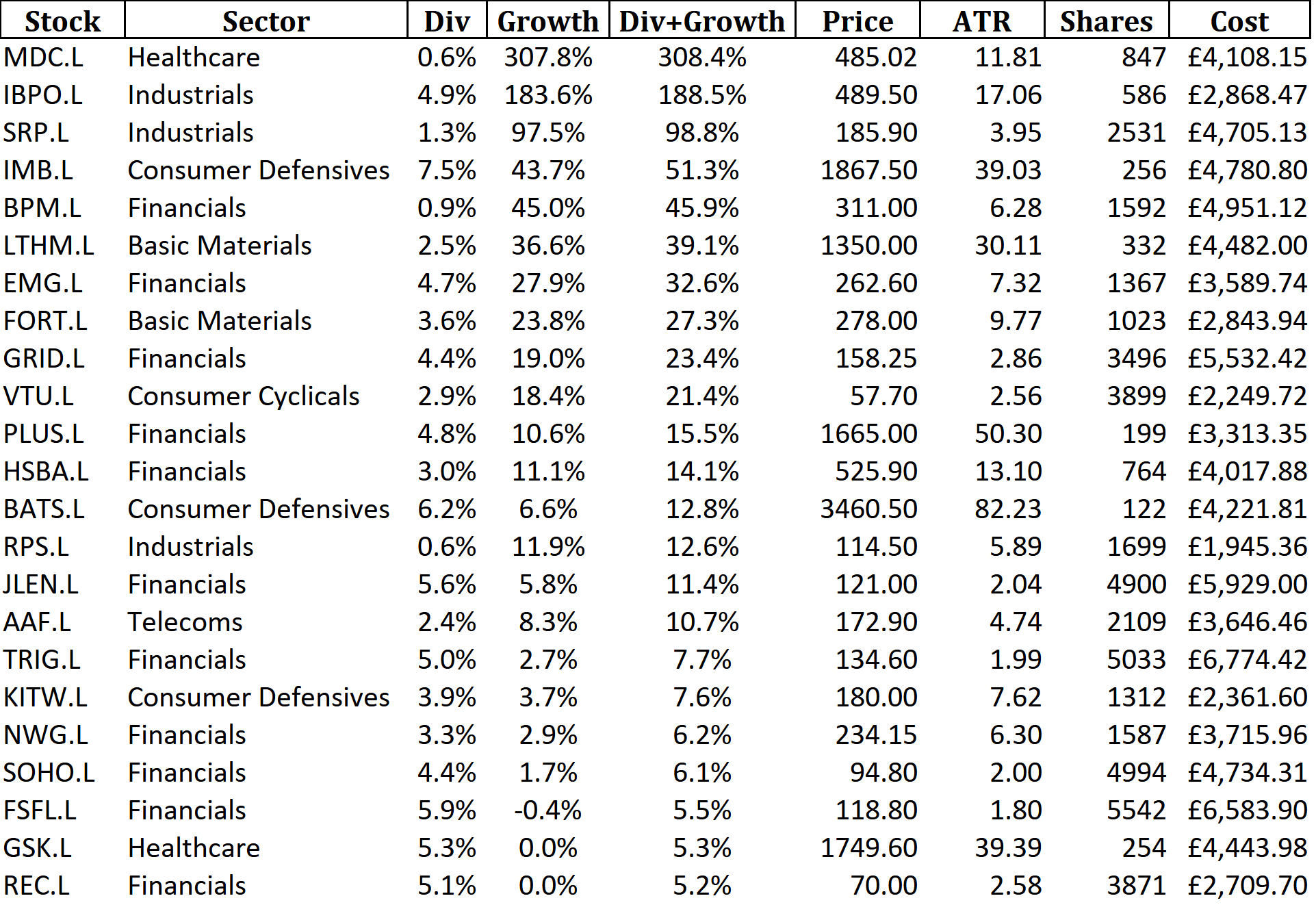

Nonetheless, two funds from the excellent Slater Investments would have beaten the NAPS. It’s worth noting that we co-acquired Company REFS with Slater Investments several years ago and know them well. REFS was the product devised by Jim Slater and the inspiration for Stockopedia.com. Slater’s Zulu Principle is a wonderful read that espouses the importance of rigorous selection rules based on quality, value, growth and momentum. I’m not surprised that an investment firm that sticks to…