In my last article, I wrote about how turnaround stocks may be a good place to invest right now and some ways to screen for these types of stocks. The screen I produced had 29 results. Here is a first look at seven of those:

Works co uk (LON:WRKS)

Investors will no doubt be aware of this chain of high-street shops. They describe themselves as "the retailer of affordable, screen-free activities for the whole family," which is a clever way of rebranding, given the evidence that excessive screen time can rewire children's brains in undesirable ways. This is one of the highest VM-Ranks, and when I reviewed it on last week's DSMR, I suggested this was only going to increase in the short term:

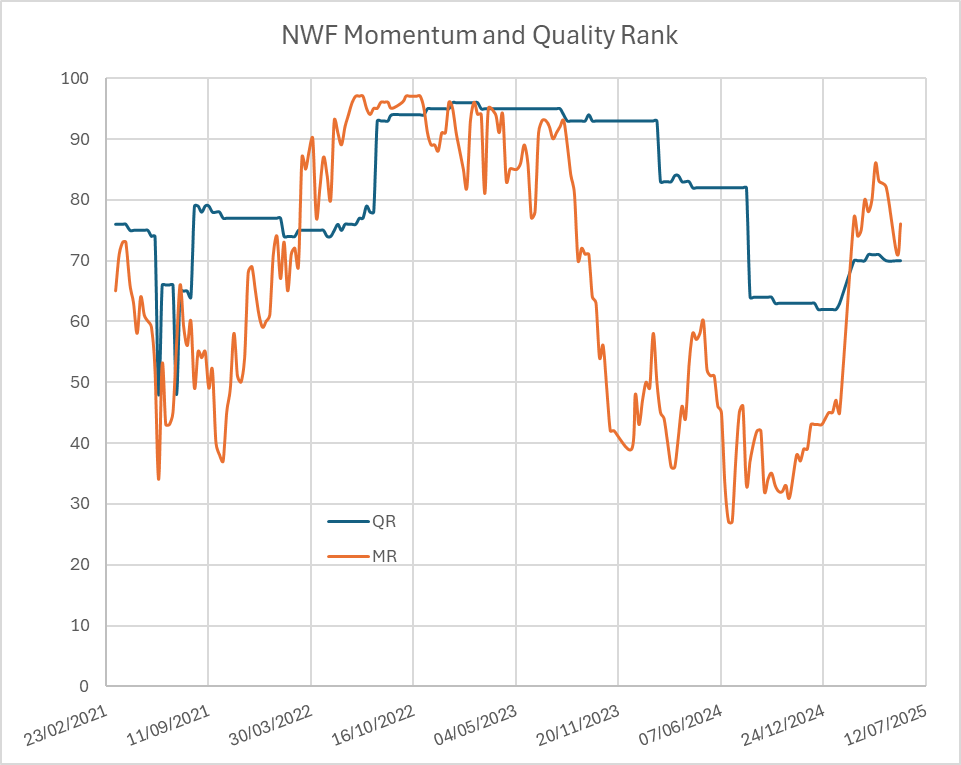

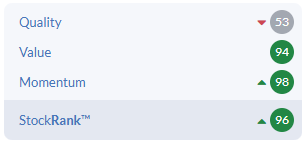

A strong recent share price aids the Momentum Rank:

In addition to the share price momentum, the company has recently demonstrated fundamental momentum by beating expectations. This is what they said last week:

Group compiled market forecasts for FY25 and FY26 are currently pre-IFRS16 Adjusted EBITDA of £8.5m and £10m respectively…

The Board expects that the positive momentum seen since Christmas will continue. This, combined with ongoing focus on product margin growth, cost management and execution of our new strategy, means we expect to offset significant cost headwinds and deliver profit growth in the year ahead. As a result, we are targeting profit growth in excess of current market expectations in FY26.

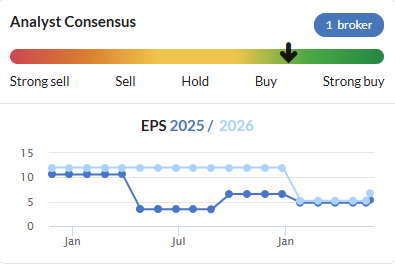

The upgrades look relatively small compared to a downgrade last year:

Although their broker, Singer, say:

The group's wide-ranging strategic and operational focus is starting to deliver results, with evidence being seen in Q4 in sales, margin and cost efficiencies. This leads to guidance being upgraded, and we have raised FY25/FY26 EPS forecasts 12%/30% now with a 25% CAGR.

So, this was a sizable upgrade for FY26. I think the strength of the reaction was because the market had expected them to miss expectations rather than beat them due to the general UK retail malaise. The company remains very cheap on many measures despite the recent share price moves:

The lack of asset backing and dividend payout are the…