Severfield-Rowen (LON:SFR) are an attractive business mostly, I expect, because of that they do. They call themselves the 'market leader in structural steel'; and what that sums to for the investor is a group which operates at nearly all levels of the supply chain. They will design the steel structure (no mean feat in itself), fabricate it at one of their plants, and erect it. That, to me, sounds like an attractive business model. It is steel-making in the 21st century. It's hardly all roses and sunshine, though, or I wouldn't be discussing it - and I remember a phrase from my piece on Speedy Hire which seems neatly appropriate here:

Doing a quick 'first response' to that list points to their customers being companies related to construction, infrastructure investment and the like. That's an accurate appraisal, and takes us quickly from premise - the company has suddenly stopped performing as well as it has historically - to reasoning; they got dragged down as the boom turned to bust.

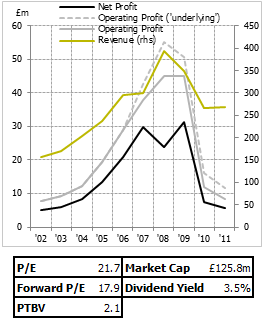

That's a value blogger for you. Even reusing his own writing! Revenue and profits have tanked during the recession; though given what I would've expected fixed costs to be in an industry like this, I'm surprised they remained profitable with such a large slump in revenue. Management do note that they have cut capacity, so it seems they did the right thing, and also suggests a good market position.

Looking at the box on the right then, Severfield-Rowen probably look a little unusual. They're not obviously cheap by earnings, or obviously cheap by assets. Hence the title of the post - the real question is one of normalisation and cyclicality. We're presented with a group trading at a market cap of £125m - and only a few years ago they were making between 25 and 30 million a year in net profit. Are those times gone forever?

I'm not entirely convinced either way on this one. While construction spending - particularly on the sort of big projects Severfield-Rowen are involved in - is probably overly depressed at the moment, there's still more to bite for the public sector. Looking back to '07 with jealous eyes is equally dangerous, since those weren't realistically 'normal' times for construction either. Something in the middle seems realistic and if…

.png)