It was a good trading day Tuesday with Dow Jones industrial Average gaining over 2 per cent. The index rose above its near-term resistance of 25400 to close at 25798.00 points. Same with the S&P 500 index that closed at 2809.92 levels, gaining 59.13 points.

As the market goes up and down, we found some short term opportunities. We have selected stocks that have a volatility percentage of close to 11 or lower and liquidity of 200 million dollars or above on a monthly basis.

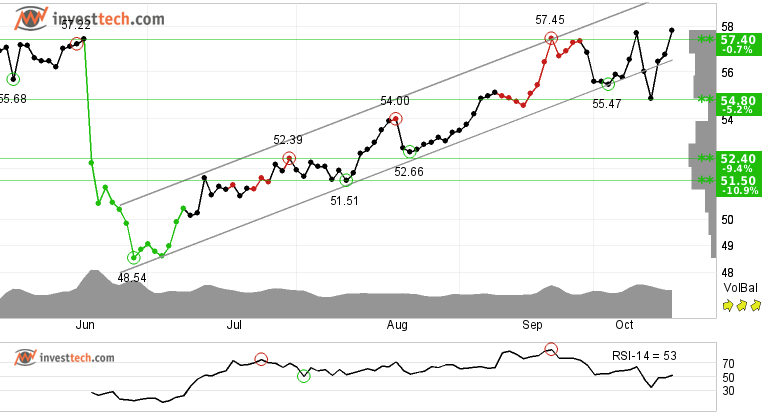

Starbucks Corp, Close: 57.81

Starbucks Corporation is inside a rising trend channel in the short term. After a minor correction and taking a support around 54.80 dollars, the stock rose again and this time above its resistance of 57.40 levels. This may be a good short term opportunity.

The next resistance is 3 % higher than last close, that is at 59.60 in the medium term graph.

Stop loss - if the price closes below 54.80 in the medium term and 53.80 in the short term.

The stock has a monthly average volatility of 7.47 percent and has a turnover of over 650 million USD.

Starbucks Corporation is estimated to report earnings on 11/01/2018.

Investtech's outlook (one to six weeks): Positive

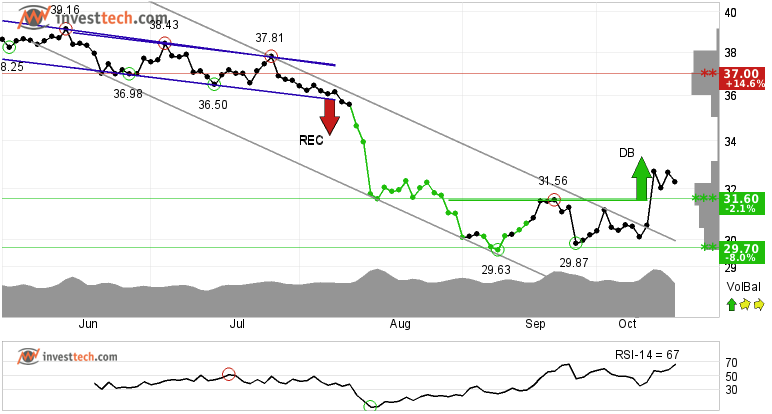

Newmont Mining Corp, Close: 32.29

Newmont Mining Corp has broken up from a falling trend channel. The stock is now trading above its resistance of 31.60 dollars and has given a buy signal from a double bottom formation in the short term. Further rise in price is indicated.

Target from the price formation is 33.50 dollars. But next resistance is around 37 dollars, 14 per cent higher than last close. Support is between 31.60 and 29.70. This overall gives a favourable risk reward ratio both in the short and medium term.

Newmont Mining has a monthly average volatility of 8.9 percent and turnover of around 200 million dollars.

Newmont Mining Corporation is expected to report earnings on 10/25/2018.

Investtech's outlook (one to six weeks): Positive

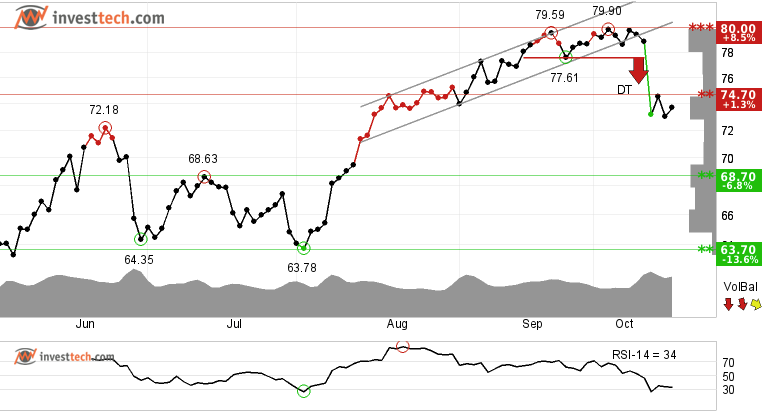

CVS Corp, Close: 73.72

The healthcare company CVS Corporation has recently broken down from a rising trend channel and has given a sell signal from a double top formation. The stock price also broke below its earlier support of 74.70…