When oil producers’ cartel OPEC announced plans for a modest production cut last week, reactions were mixed.

OPEC’s commitment to cut production to between 32.5 and 33.0 million barrels per day implies a cut of between 240,000 and 740,000 b/d from August’s production level of 33.24mb/d. The hope is that this might be enough to help rebalance the market without sacrificing too much of OPEC’s market share.

Saudi-led OPEC has resisted a cut until now in order to defend its market share. Instead, OPEC producers have aggressively ramped up their oil production over the last two years. OPEC oil production in August 2014 was 30.35mb/d. Last week’s proposed cut still represents a production increase of more than 2mb/d compared to two years ago.

The problem now is that many OPEC countries are desperate for the influx of cash an increase in the price of oil would provide. They’ve seen US oil production fall by around 600,000 b/d over the last year. They may believe that by making a similar cut, they can erase the remainder of the global supply glut and lift oil prices.

We’ll have to wait until November to find out more. So far, western oil companies that have adopted the lower for longer mantra have been proved right. But having followed the oil market quite closely over the last couple of years, my personal view is that we are getting closer to a recovery.

Even if I’m wrong, I believe most diversified portfolios should have some exposure to the energy sector. At present, the SIF portfolio does not have any oil stocks. In the remainder of this article I’ll explain why, and take a look at some possible choices.

Why are there no oil stocks?

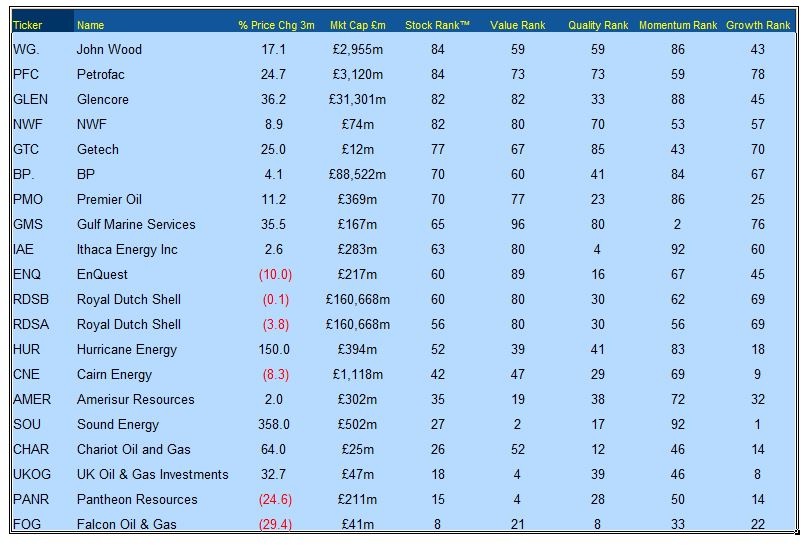

I do own some oil stocks in my personal portfolio. But I have not added any to the SIF portfolio because with one exception, none of the stocks in the UK oil and gas sector have qualified for my screen.

One reason for this is that the screen isn’t intended to pick up cyclical stocks exiting a major downturn. The screen is designed to identify companies that are already profitable and have the potential to deliver above-average returns.

The oil sector has a poor track record in this regard. When Brent crude oil traded above $100 almost continuously from 2011 until mid-2014,…