Dividend strategies are popular amongst UK investors. The ability to receive a market-beating passive income from simply holding large, steady companies is incredibly attractive to those who use their stock portfolio to help with living expenses. There is evidence that this kind of Value strategy beats the market over the very long term, although perhaps by less than other value strategies.

Towards the end of 2022, I wrote an article proposing a Value-first strategy. I suggested investors would be better off screening for stocks that meet Value criteria first and then picking a diversified collection of the highest-yielding stocks out of these. However, when I reviewed this strategy in 2023, the results were a little disappointing. What I called the “Safer Income Portfolio” beat some other simple value strategies. However, it underperformed the FTSE All Share, at least on price-performance:

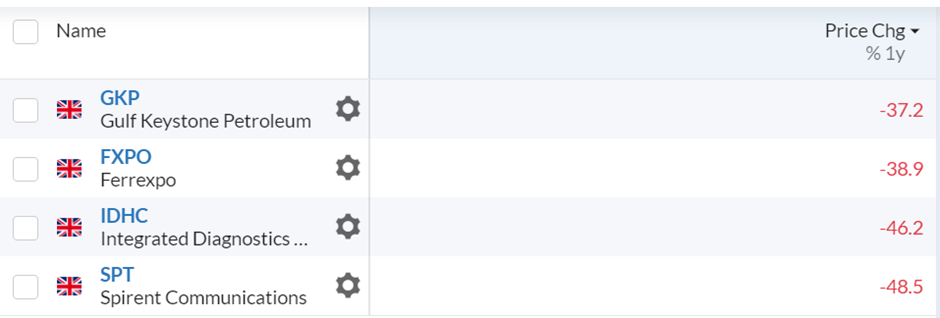

More disappointingly, the portfolio contained four companies that cancelled their dividend payout:

And some that cut their dividend while not completely cancelling it:

It seems that this income portfolio was not safe enough, and in my mea culpa, I concluded that:

…the riskiest holdings have done the real damage. These stocks clearly had significant political risks when the portfolio was formed...It can be tempting to “juice” the income portfolio with high-yielding but risky or under-diversified stocks. With the benefit of hindsight, I would have picked much more stable businesses from these industry sectors.

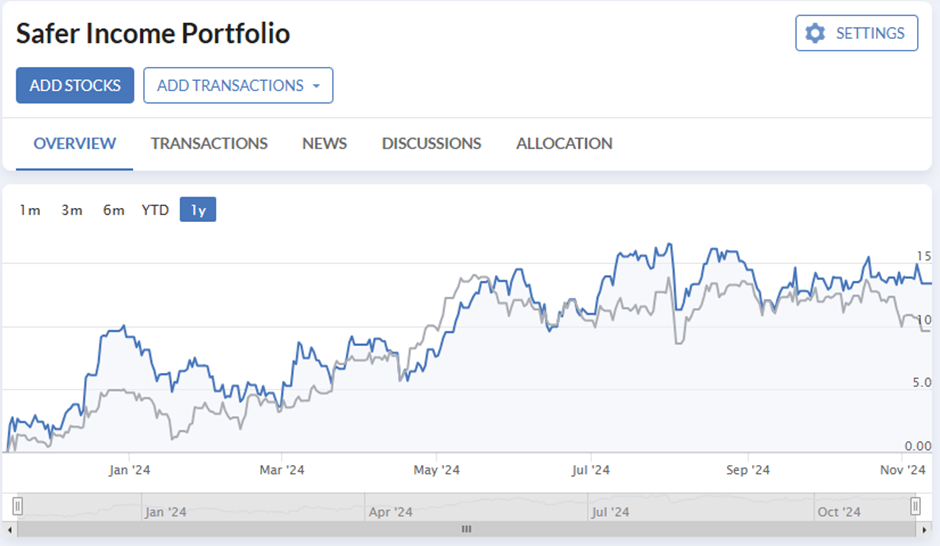

However, fast forward another year, the “Safer Income Portfolio” has recovered its underperformance:

Although the dividend cuts hurt the income, it still delivered a 4.8% TTM dividend yield, meaning that the two-year performance of the strategy appears to have slightly outperformed the wider market on a Total Return basis. This is despite a few more shares joining the dividend cutters, such as EKF Diagnostics Holdings (LON:EKF) , Spirent Communications (LON:SPT) and Headlam (LON:HEAD) .

This leads to an interesting question:

Should I sell if an income stock cuts or cancels its dividend?

Many income strategies simply sell if a dividend is cancelled and reinvest the proceeds elsewhere. The logic seems sound. If investors are relying on that income and…

.JPG)