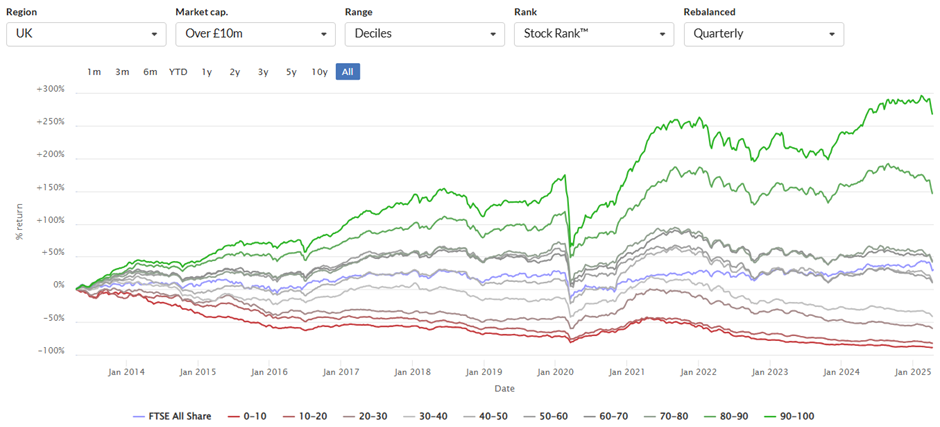

Should investors always avoid lowly ranked stocks? sounds like a question with an obvious answer. After all, Stockopedia subscribers will know that the lowest-ranked stocks on the QVM measure, which we often call Sucker Stocks, have a terrible track record:

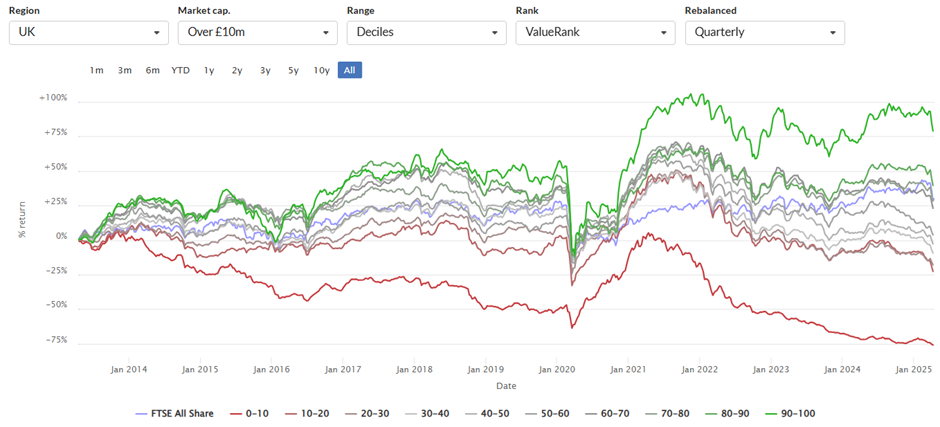

However, in a recent article, I raised an uncomfortable possibility. Since the lowest-ranked stocks on each of the ranks perform very poorly, should investors avoid the lowest-ranked stocks for each of the individual Q, V, and M ranks? For example, here is the long-term chart of the performance of the Value Rank in the UK:

As expected, the average stock with a Value Rank below 10 performs terribly over the long term. Included in that set of stocks will be some real stinkers, such as persistent loss-making companies with no asset backing. However, there will also be some High Flyers, stocks with high Quality and Momentum Ranks that have risen so far that the Value Rank is now very low. Do these stocks buck the trend and keep performing, or does that low Value Rank drag them down like the rest of the lowest-ranked stocks? After all, Momentum investors need to be wary of “Stale Momentum”, where stocks have Momentum for so long that corporate mean reversion is the more powerful effect.

Alex has helped me answer this question, together with the equivalent questions for the other “crossover” styles: Should Contrarian (high QV) Investors avoid stocks with a low Momentum rank, or should Turnaround (high VM) investors avoid low Quality-ranked stocks?

The test

To answer these questions, Alex has backtested investing in an equal-weighted portfolio of each “crossover” stock style. For technical reasons, using the Stock Style classification itself makes the effect hard to measure. So, instead, we have gone for a simple setup. To measure the impact of Momentum on Contrarian stocks, we looked at the set of stocks that are greater than 75 on both the Quality and Value Ranks and asked the question, how do portfolios of the different quartiles of Momentum Rank perform? We go back 10 years with annual rebalancing. The same goes for the other “Stock Styles”.

The results

Contrarian Stocks

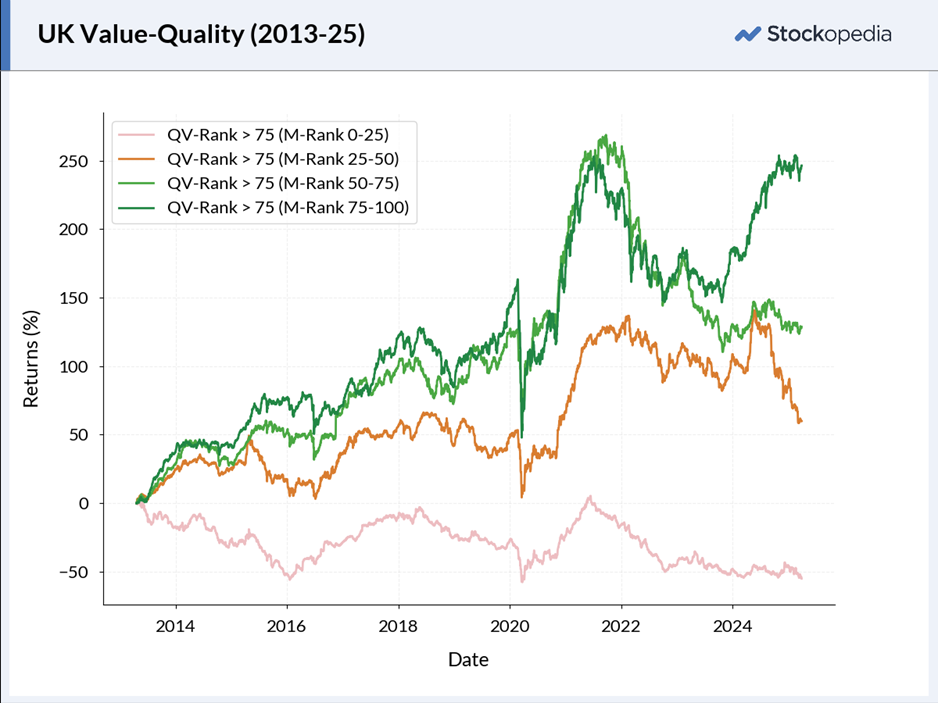

For contrarian stocks, the Quality and Value Ranks are high (>75), and we look at the impact of the varying Momentum Rank on these stocks: