Shares in market-leading promotional goods business 4imprint (LON:FOUR) have fallen by around 50% from their 2024 peak. Despite recent gains, I estimate they may now be trading more cheaply than at any time since 2012.

Admittedly, earnings expectations have fallen and 4Imprint remains under pressure from tariff headwinds and softer demand in its core US market. However, I believe the underlying quality of this business remains very high and would argue that the valuation most likely already reflects any near-term weakness.

The current share price is also underpinned by a strong balance sheet and a 4.5% dividend yield, providing an attractive income for shareholders ahead of a possible turnaround.

I believe a return to top-line growth could drive rapid profit gains and a potential share price re-rating.

Summary

Pros:

Super quality metrics; net cash and 80%+ return on equity;

Market leader with attractive market share;

Current valuation is unusually cheap for this business; well-supported dividend provides an above-average income.

Cons

98% of sales from North America; heavy US exposure and uncertain outlook;

It could be too soon to buy; profits are expected to fall further in 2026 as 4Imprint gradually absorbs higher input costs;

Large market share means further gains may struggle to move the needle.

Profile

About the stock

4Imprint sells promotional products using a direct marketing model. The group’s operations are in North America, the UK and Ireland. The majority of sales are in the US and Canada.

4Imprint is a member of the FTSE 250 index, with a market cap of £1.1bn and a recent share price of around 4,030p.

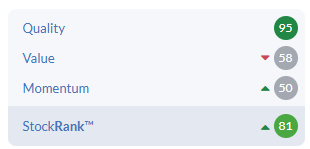

The StockRanks highlight the company’s strong QualityRank, but value and momentum scores are more middling – this mix is reflected in the stock’s Neutral styling:

About the opportunity

4Imprint is suffering from twin headwinds that are holding back profits. In its core US market, orders from existing customers have been broadly stable this year, but softer demand has limited new customer recruitment.

At the same time, cost inflation and the impact of tariffs mean that product costs are rising. 4Imprint is expected to absorb some of these cost increases in order to protect its market share. As a result, profits are…