Back in February 2020 we set up the Stockopedia Investment Club as an office initiative that we could also share with the wider community. As you can imagine, coinciding with a global pandemic means it has been quite the ride so far.

In this short time, we've enjoyed the euphoric highs of multibagging success, the boredom of watching stocks do nothing (the phrase don't just do something, sit there! comes to mind), and the plummeting lows of profit warnings.

You can find the first review here. Happily, we continue to outperform our All Share benchmark but the gap has narrowed in the first half of 2021. However in Ed's SNAPS piece, he shows that the purely mechanical factor-based Folio was up some 31% in the first half.

So even though we're beating the market, there's room for improvement.

Portfolio performance

A blockbuster 2020 saw encouraging outperformance for the Club. The first half of 2021 has been slightly tougher going but we continue to outperform the All Share benchmark.

The Club returned 15.45% in the first half of 2021, compared to 10.68% from the benchmark.

That's a creditable result given what feels like slightly more mixed markets recently - the rally continues, but at a much reduced pace.

More meaningfully, the Club Portfolio is up 55.8% on a cash-adjusted basis since inception (February 2020), compared to an All-Share return of -2.02% over the same period.

Changing markets

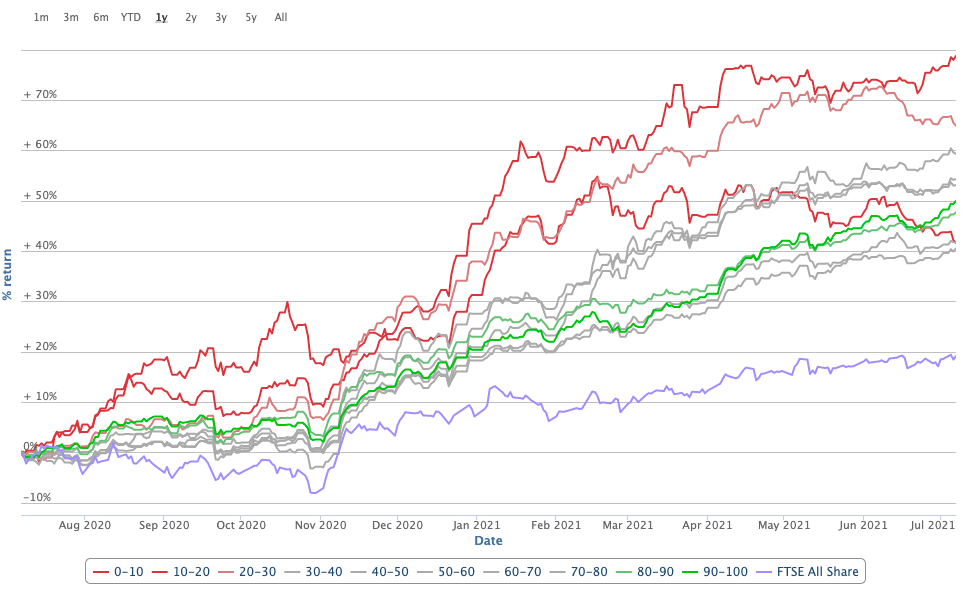

In the aftermath of the initial lockdowns, it felt like riskier more speculative stocks were in the ascendancy. This is quite clear in Stockopedia's own Quality Ranks.

You don't see this kind of inverted chart too often, but here's how stocks have performed over the past year by Q Rank decile.

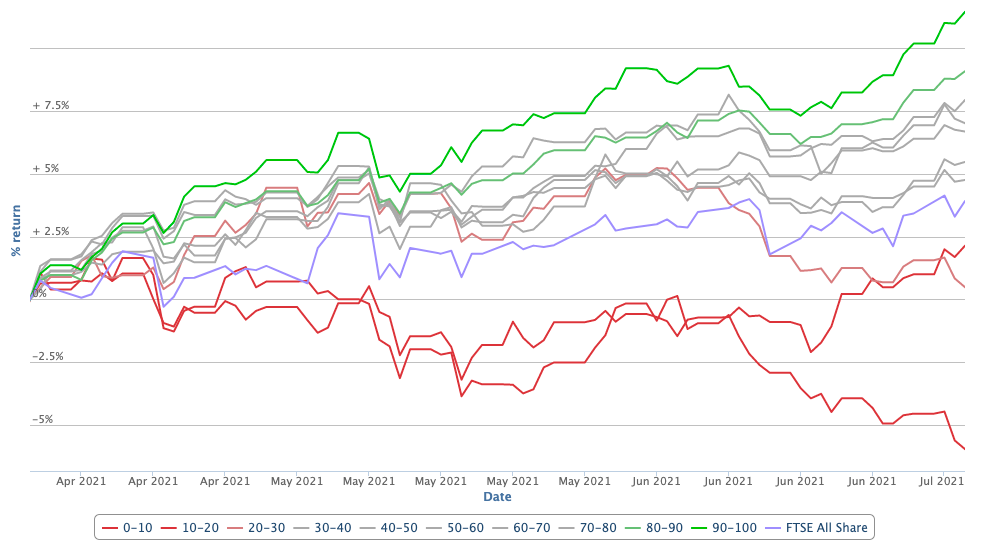

What's interesting is when you hone in on the most recent three month period. It's starkly different to the previous trend and suggests a return to more 'normal' conditions.

Performance drivers

Here are the winners and losers of the Folio - due to time constraints I haven't included dividends and have assumed equal weightings. It does show a positive win:loss ratio of 1.25x, but one that can be improved.

Including the dividend we've received from IG would bring that position into positive territory, which would make for a ratio of 1.57x. It…

.jpg)