Many thanks for all your comments on my SIF annual review last week. I do read them all. I’m still thinking through the implications of changing my methodology and will post an update here when I’m ready to move ahead.

In the meantime, I’m maintaining my existing processes for buying and selling stocks from SIF. As it’s the last week of the month, this means it’s time to review shares that have been in SIF for at least nine months.

Two companies make the cut this month. Both have been strong performers since I added them to SIF in July 2020:

Tatton Asset Management: this small cap offers a suite of services to financial advisers, including asset management

Wynnstay: manufacturer and supplier of agricultural products, such as animal feed

I’ll look at each of these in more detail in a moment. But let’s start with a look at the performance of the portfolio over the last month.

SIF folio: April performance

The portfolio has gained 6% over the last month. This has kept SIF ahead of the market and lifted the folio to a new all-time high:

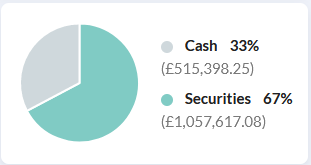

After last month’s sales, the cash position remains very high, at roughly 33%:

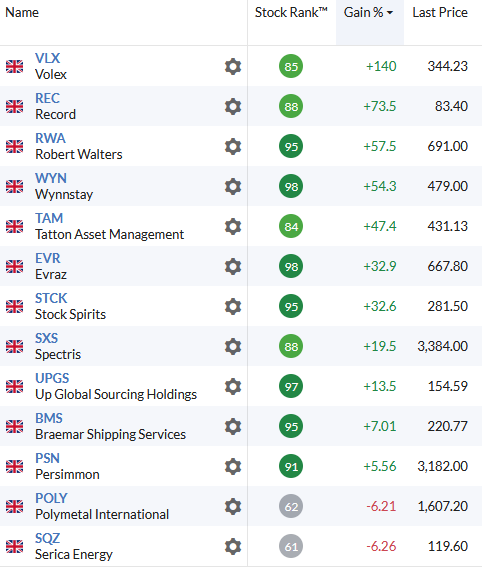

Finally, here’s a full list of the portfolio’s holdings on 26 April, before any transactions that might result from this review:

Now let’s move onto the individual stock reviews.

Tatton Asset Management (LON:TAM)

Tatton’s share price hit a new record high last week after the company issued a bullish full-year trading update, bumping up guidance for the year ended 31 March 2021:

“The Board expects FY21 results to be ahead of all analysts’ forecasts”

The main highlight seems to have been Tatton’s investment management business. This provides discretionary fund management services for financial advisers. According to management, net inflows rose by 30% to £427m during the second half of the year, compared the first half period.

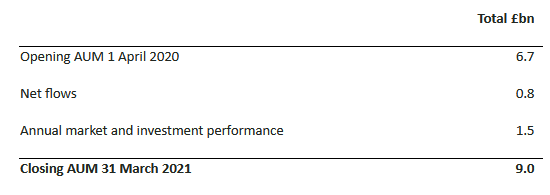

Net inflows for the full year were £755m, representing 11% of opening assets under management:

Mortgage activity has also been strong, thanks in part to the boost provided by the stamp duty holiday. Tatton says gross lending rose by 20% to £6bn during the second half, giving a full-year…