August has been another benign month for the stock market and for my SIF systematic portfolio. I’m writing this monthly review a week earlier than usual due to next week’s bank holiday. But barring any nasty shocks over the next four days, both SIF and the wider UK market look set to end the month with modest gains.

As usual, this review will cover all the stocks that have been in the portfolio for my minimum period of nine months (or longer). Three stocks satisfy this criteria this month. Two have already been held over from previous months, while one has reached its first review date.

Polymetal International (LON:POLY) - this Russia-based gold miner has delivered a stable operating performance but growth seems to have stalled.

Tatton Asset Management (LON:TAM) - this financial advisor platform provider has been a big winner so far for SIF. Can I keep holding?

Robert Walters (LON:RWA) - recruiters are performing well at the moment and momentum looks strong.

I’ll take a look at each of these stocks in a moment, to see whether they still satisfy my screening criteria. But first, let’s take a quick look at the portfolio itself.

SIF Folio: August performance update

Regular readers will know that I try to avoid making predictions about the direction of the market or macro-economic trends. My system is to let my rules control the makeup and cash weighting of the SIF (Stock In Focus) portfolio.

As a natural pessimist (realist?), I expect a reality check at some point. But for now I’m happy to report that SIF has continued to outperform the market in August.

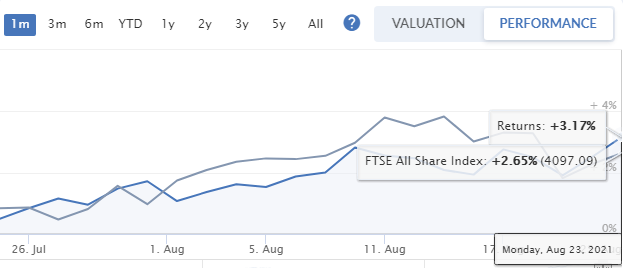

According to the Stocko charts, the SIF folio rose by 3.2% during the month to 23 August. This compares to a 2.7% gain for the FTSE All Share Index, which I use as a benchmark.

Note that I’m using the excellent new time-weighted return performance view on these charts. This adjusts out the impact of any cash inflows and outflows, providing a true view of portfolio investment performance versus the benchmark.

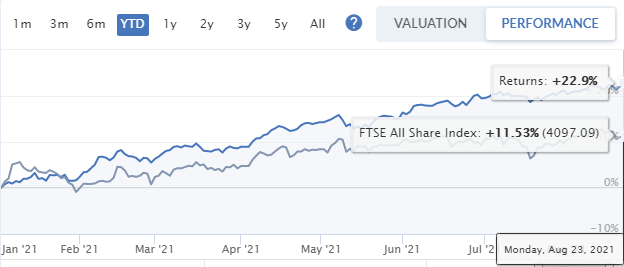

Over the year to date, the portfolio has doubled the return of the wider market:

Finally, since the portfolio’s inception in April 2016, it’s…