Gold remains a popular topical subject in the investment world, not least because Warren Buffett recently bought a $500m stake in miner Barrick Gold. Paul discussed this deal here.

As we’re approaching the end of the month and next Monday is a bank holiday in the UK, I’m carrying out my usual month-end review for August this week. There are two stocks in the SIF portfolio which have been in place for more than nine months and thus are due for review. Coincidentally, the two companies concerned are those which provide the portfolio’s gold exposure:

If these stocks no longer pass all of my screening tests, then I’ll have no choice but to divest both, stripping SIF of its exposure to the yellow metal.

What’s gold been doing since last month? Here’s an updated version of the chart I used in my July review:

Source: IG Index

This long-term monthly chart doesn’t tell us all that much about recent movements, but we can see that gold’s ascent has paused over the last month. Here’s how the last six weeks look on a four-hour chart:

Source: IG Index

I’m not a chartist, but I would guess that this chart suggests a consolidation that could break out higher or lower in due course.

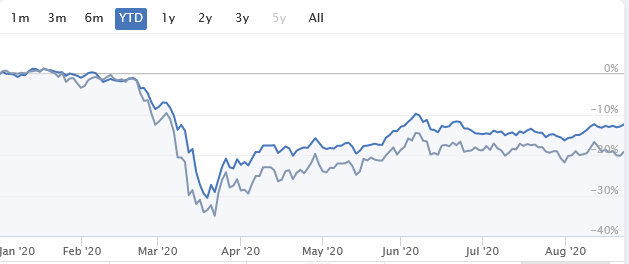

I don’t really have a strong view on which direction gold might move next. I prefer to focus on the performance and fundamentals of the stocks in the SIF folio. Here’s how the portfolio has performed over the year to date (the blue line is SIF, grey is the FTSE All-Share):

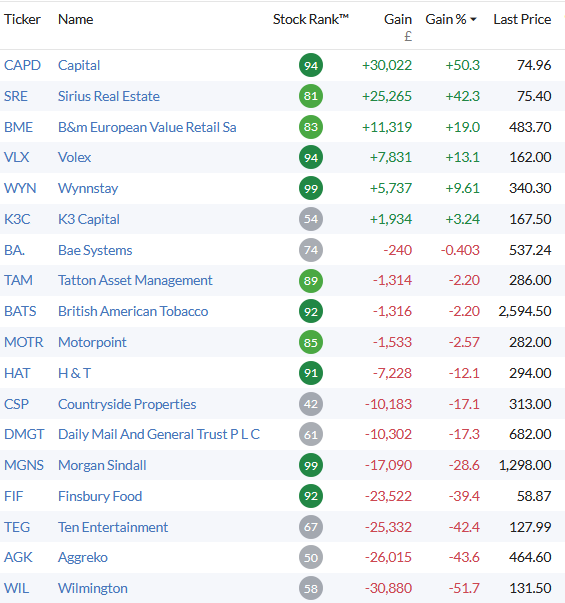

And here’s a stock-by-stock breakdown of the current positions in SIF:

Capital is the biggest riser currently in the portfolio. H&T has languished. The impact of the lockdown closure of its shops has been greater than the benefit it might have enjoyed from gold’s rise.

Let’s take a closer look at each company.

Capital (LON: CAPD)

(Original coverage: 02-Jul-2019)

Capital’s half-year results were published last week. As you’d hope, the headline numbers were pretty strong:

- Revenue up by 19% to $65.1m

- Operating profit up by 21.5% to $9.6m

- Operating margin stable at c.14.5%

- After-tax profit up by 166% to $13.6m

I’ll stop…