It looks like we’re heading for an unsettled end to the year, given the combination of Covid-19 restrictions and Brexit uncertainty.

With Christmas coming up I’m planning to take a few days off, so in a slight change to my normal schedule I’m going to carry out my usual month-end review a week early. I’ll then follow up with a review of the portfolio’s 2020 performance at the start of January.

March’s market crash triggered something of a buying spree for SIF. Four new stocks joined the portfolio during that turbulent period nine months ago. They’re now due for an initial review against my new selling rules. There’s also one position that’s been held over from January which needs to be checked. Here’s the list of companies I’ll be looking at this week:

Motorpoint

Morgan Sindall

Ten Entertainment

Sirius Real Estate

British American Tobacco

There’s a lot to cover, so without further ado let’s get started.

SIF Folio: December performance

The portfolio has pretty much tracked the wider market so far in December:

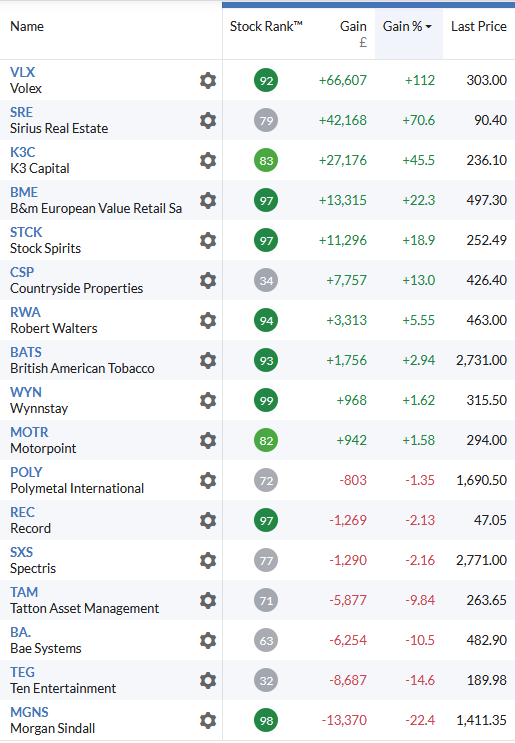

Here’s a snapshot of SIF’s holdings as of 21 December:

Motorpoint Group (LON:MOTR)

This used car supermarket chain has had a strong year despite the disruption caused by lockdown. I reviewed Motorpoint’s recent interim results in my November review, so I won’t repeat myself here.

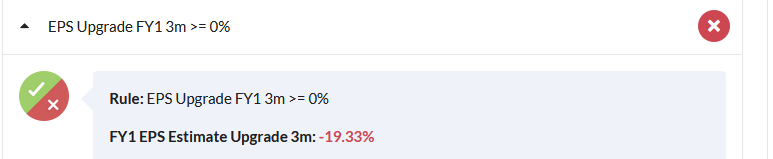

I remain a fan of this company which passes all the tests in my sell screen, bar one:

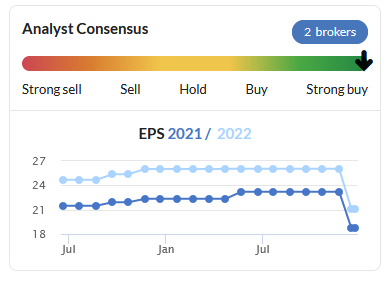

Normally, this would imply that a profit warning had taken place. But that’s not the case here. Instead, I think that reason for this is that the recent resumption of guidance and broker coverage has caused a dislocation in Stockopedia’s record of broker forecasts.

What I’ve found this year is that Stocko’s broker trend charts have shown unchanged forecasts during periods where company guidance (and thus broker coverage) has actually been suspended. When forecasts are resumed, the consensus trend shows a sharp revision, as we can see here with Motorpoint:

I’m not inclined to sell this stock on a technicality when the company is performing well and passes all of my other screening tests. So I’ll continue to hold Motorpoint into the new year.

Verdict: Hold

Total return to date:…