My Stock in Focus portfolio celebrated its fourth birthday on 19 April. At the time, I was spending a lockdown weekend doing battle with a neglected corner of the garden.

When I returned to my screens on Monday morning, I found that my rules-based virtual portfolio was worth 14% more than it was on launch day in April 2016.

To put this in context, on the portfolio’s third birthday last year, SIF was showing a gain since inception of 40%. Although the last year has not been kind to my portfolio, SIF has continued to fulfil its original brief of outperforming the market:

(blue line is SIF, grey line is FTSE All-Share)

After the worst stock market crash since 2008, SIF is showing a 14% gain since April 2016. Over the same period, the FTSE All-Share Index (grey line) has fallen by about 12%.

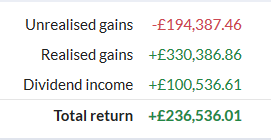

With dividends added, the total return since inception from the folio is a healthier 24%, after costs:

Never underestimate the power of income! Although my focus is on capital gains, dividends have added about 2.5% per year to my original (virtual) fund of £1m.

Cash weighting provides crash hedge

It’s fair to say that the market-beating performance SIF delivered in its first two years hasn’t been maintained. 2018 was pretty flat and there were some signs of underperformance in 2019.

My screen didn’t serve up many potential buys last year and the portfolio gradually shifted to cash. When the stock market crash gathered pace in early March, nearly 40% of SIF was in cash.

However, this heavy cash weighting has proved to be a useful hedge to the worst stock market crash in a decade. Indeed, SIF’s cash has helped the portfolio outperform the market since the crash begun, acting as a passive hedge:

The portfolio’s sizeable cash balance also allowed me to make a number of purchases in March, without having to sell anything.

Shopping spree

Regular readers will be aware that I’ve celebrated the recent stock market crash by going on a shopping spree. In March I added four news stocks to the SIF folio. This was the most I’d bought in one month since September 2019.

The four stocks…