This week I want to look at British American Tobacco (LON:BATS) - a well-known FTSE 100 stock that’s a recent addition to the results of my SIF stock-buying screen.

One of the pillars of fund manager Neil Woodford’s post-2000 success was his fund’s investment in FTSE 100 tobacco stock British American Tobacco (LON:BATS) – the owner of brands such as Camel, Dunhill and Lucky Strike.

Woodford identified BATS as a value buy with strong cash flows and an attractive dividend yield. He was right to do so. Between 2002 and the stock’s 2017 peak, BATS gained more than 650%. Not bad for an old-world, mature, and supposedly declining business.

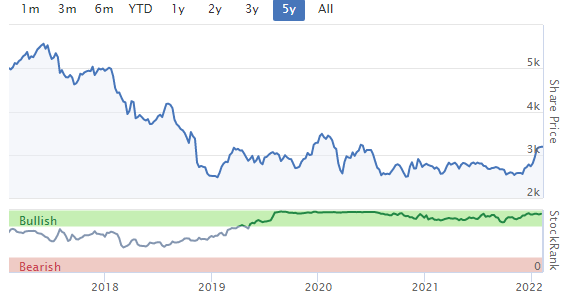

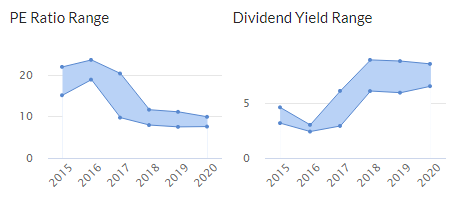

Shares in BATS peaked in 2017. They’ve since fallen by more than 40%, making BATS one of the cheapest shares in the FTSE 100.

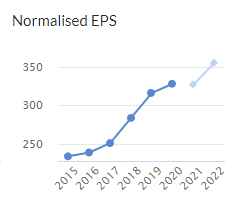

In my view, this decline isn’t fully justified by the recent performance of the underlying business.

There are obviously legitimate concerns about regulatory risk here. BATS’s primary product is extremely hazardous to health and could face further restrictions. The structural decline in smoking rates is also a worry. At what point will smoking become unviable as a mass market activity, at least in western markets?

I don’t know the answers to these questions. But I think it’s possible that population growth in emerging markets might mean that global smoking volumes fall more slowly than expected.

On balance, my feeling is that we might be seeing history repeating itself. Just as old-fashioned value came back into fashion when the first tech boom ended 20 years ago, I wonder if we’re now seeing a rotation from highly-rated ESG/tech stocks into value.

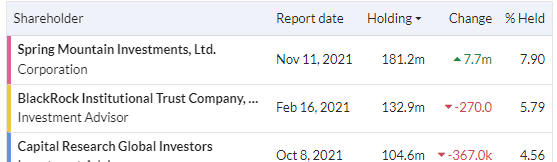

I’ve viewed BATS as a classic value stock for some time now. It seems I’m not alone. BATS’s largest shareholder is now Spring Mountain Investments. This is a vehicle controlled by billionaire Kenneth Dart, who made his name investing in distressed debt.

Mr Dart is also the second-largest shareholder in Imperial Brands (I hold), according to Stockopedia data.

What could happen to justify a re-rating of BATS stock?…