This week I’m continuing my hunt for reasonably-priced defensive stocks I can add to the SIF Folio. Last week I considered high street cake shop Cake Box Holdings, but I couldn’t convince myself to hit the buy button.

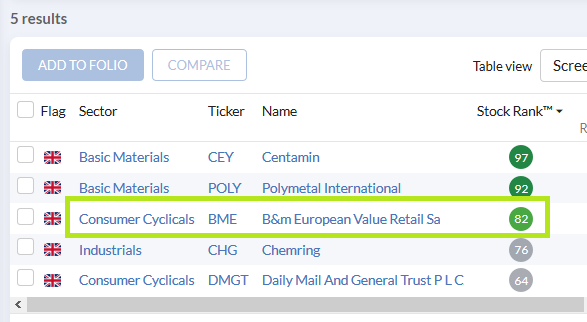

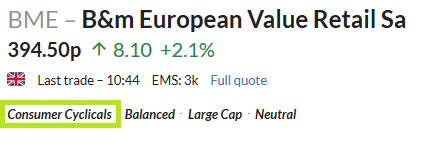

My next candidate is variety discount retailer B&M European Value Retail SA (LON: BME). This £3.9bn FTSE 250 firm has popped up on one of my stock screens recently as a potential SIF stock.

If you haven’t visited any of B&M’s 656 stores before, they’re roughly the size of an Aldi or Lidl supermarket and target a similar customer base. B&M sells a wide variety of goods including:

Non-perishable, ambient groceries

Fast-moving consumer goods (FMCG), including branded products

Homewares

DIY/gardening

Seasonal products

Pet supplies

This product range is carefully curated and includes around 100 new lines per week. This focus on novelty is combined with a good mix of staple value items to ensure customers make regular repeat visits.

B&M also runs 293 convenience stores under the B&M Express and Heron brands, plus 101 stores in France under the Babou and B&M brands.

The group is run by CEO Simon Arora. Mr Arora acquired the business with his brother Bobby in 2004, when it had just 21 stores. Bobby Arora is B&M’s trading director - I believe his expertise in product selection and sourcing is a crucial element of the group’s success.

Owner-manager attraction?

The core B&M model appears to work well. Group revenue has risen from £2,035m in 2016 to £3,813m last year (y/e 28 March). Broker forecasts suggest group revenue will rise to £4,133m this year, making this a potentially impressive growth story.

Although the Aroras have sold down a significant amount of their stake, they remain 15% shareholders through their Luxembourg-based investment vehicle, SSA Investments S.a.r.l. A third brother, Robin Arora, also owns a 3% stake.

A defensive pick?

B&M’s focus on everyday essentials allowed the group’s UK stores to remain open during lockdown. This makes it one of an elite group of retailers who’ve reported strong results this year.

Although this business is listed in the consumer cyclicals sector, I think B&M’s product mix and value focus means that it’s worth considering as a defensive stock.

Modern shopping patterns…