It’s been seven weeks since I added a stock to the SIF folio. In that time, all I seem to have done is sell shares. After last week’s disposal of Wynnstay, SIF is now 38% in cash and has just 12 holdings.

This lack of buying is not due to any market-timing efforts on my part. What’s happened is that my buying screen has been unable to find suitable stocks to add to the portfolio. For many weeks, the screen has returned only a few stocks. Usually, they’ve been existing holdings or otherwise unsuitable..

This remains true. My screen is returning just four results at the time of writing. However, one of these is a company that appears to tick all the boxes and would give SIF some useful exposure to the healthcare market.

Beximco Pharmaceuticals: an unusual UK share

Beximco Pharmaceuticals (LON:BXP) is a Bangladeshi company which makes generic medicines and active pharmaceutical ingredients. It was founded in 1976 as an importer and distributor of medicines from western pharma firms. The group has since become a manufacturer in its own right and now exports widely, including to western markets. Beximco is listed on the Dhaka Stock Exchange but has had a dual listing in London since 2005.

This is not the first time I’ve looked at this business on these pages. I held Beximco in SIF in 2016/17, exiting the position in May 2017 with a 70% gain.

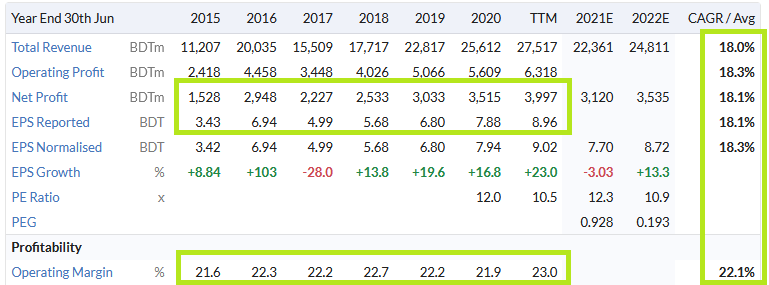

I’ve kept an eye on this business since then and have been impressed by its continued growth and stable profitability. According to Stockopedia data, sales and profits have both grown by a compound average of 18% per year since 2015. Operating margins have averaged 22% over this period.

With a UK market cap of £364m, Beximco isn’t particularly large. But one reason for this is the shares’ unusual dual listing structure and dual valuation.

The company’s primary listing is on the Dhaka Stock Exchange, in Bangladesh. Beximco’s market cap on its home exchange is a rather racier £725m. How can this be?

This situation has arisen because Beximco’s UK-listed GDRs (Global Depositary Receipt) and its Dhaka-listed shares are not fungible. What this means is that you cannot exchange a GDR for the underlying share.

This is somewhat unusual, but…