Defence giant £BA is the second-biggest riser in the FTSE 100 since the invasion of Ukraine on 24 February. Shares in the £23bn group have risen by around 25% since the invasion, and are now trading close to record highs.

Is this a depressingly cynical move by investors, or just a realistic projection of future defence spending? I’m not sure. But what I do know is that even before February, my impression was that BAE’s performance was improving.

BAE’s operations encompass aircraft and shipbuilding, electronic systems, land-based vehicles and cybersecurity. My observation is that this diversity helps to provide a hedge against the lumpiness that can afflict the income from some of BAE’s larger projects.

The company’s 2021 results demonstrated this. All of its divisions generated sales or profit growth, but at a group level both sales and profits increased.

BAE’s underlying sales (including JVs) rose by 5% to £21.3bn, while underlying earnings were 8% higher at 47.8p per share. The order backlog was stable at £44bn (2020: £45.2bn).

These adjusted figures were supported by improved cash generation and a reduction in net financial debt, which fell from £2.7bn to £2.2bn.

BAE’s famously large pension deficit also shrunk in 2021. On an accounting basis, the shortfall halved from £4.5bn to £2.1bn, thanks to strong asset performance and the impact of higher interest rates.

Guidance for the year ahead is positive, too. Underlying operating profit is expected to rise by 4% to 6%, with sales up 2%-4%. This suggests further margin improvements, following the trend of the last few years.

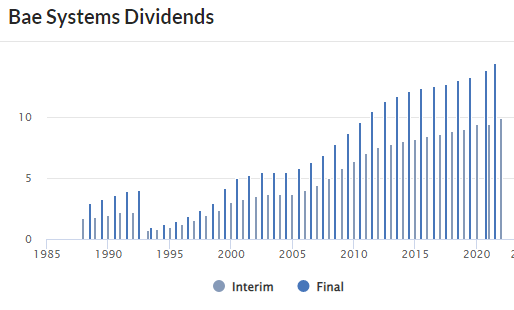

BAE has also maintained its guidance for free cash flow in excess of £1bn per year, which should cover its dividend. However, the rising share price means this implies a free cash flow yield of just 4.3%. In my view, this doesn’t seem especially cheap for a slow-growing industrial business.

However, BAE currently appears to be the top-ranked stock in my screening results that I don’t already own.

The defence group also scores well with the StockRanks, and boasts Super Stock status.

I think the shares deserve a closer look as a possible SIF buy.

Value: middling

ValueRank: 61

BAE’s ValueRank has fallen from 78 at the start of this…