My SIF portfolio delivered a gain of around 20% during the first half of 2021 - double the 10% increase delivered by the FTSE All-Share Index. While I’m happy with this result, I’m aware that the market conditions we’ve seen over the last year are not exactly typical.

For example, two weeks ago I sold Volex for a gain of 170% after just 10 months.

Of the 16 stocks which remain in the SIF portfolio, five have risen by between 50% and 100% in less than nine months.

Making money from shares isn’t always this easy, at least not in my experience. While I’d like to take all the credit, in reality I think I’ve simply profited from a broader re-rating of good companies which looked cheap in autumn 2020.

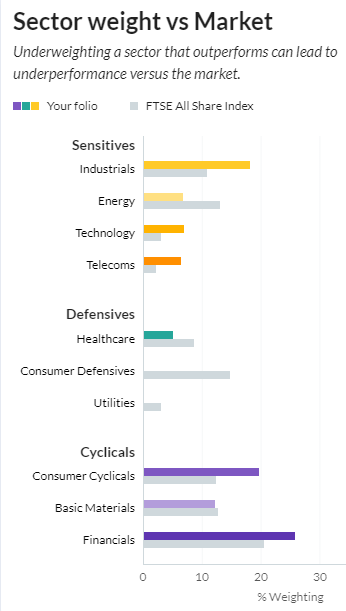

I wouldn’t be surprised to see a more mixed performance from the market over the next 6-12 months. In this context, I’m a little concerned about the portfolio’s lack of exposure to defensive stocks:

Being underweight defensive stocks has been a recurring problem throughout the portfolio’s life. Put simply, they’ve usually been too expensive - and sometimes too slow growing - to pass my screening tests.

That remains the case today. Ahead of writing this, I hunted through a number of FTSE 100 and FTSE 250 consumer defensive stocks I’d be happy to own. None came close enough to qualifying for my screen for me to consider buying without breaking my rules.

All of which led me back to reconsider the handful of stocks which do currently qualify for my buying screen.

Of these, the only one I might consider buying today is UK structural steel specialist Severfield (LON:SFR). This business provides the steelwork for a wide range of non-residential property. Past projects have included many well-known UK landmarks, such as the Wimbledon No. 1 Court and the London Shard. The company is also active in markets such as data centres and transport infrastructure.

Severfield has made regular appearances in my screening results, but the last time I looked at the company was in November 2019. At the time, I noted that the company was promising growth despite an uncertain outlook for the UK economy. I didn’t buy the shares in 2019, for several…