The stock market drought continues. My SIF share-buying screen is serving up just two shares as I write, both of which (Morgan Sindall and Polymetal International) I already own in the SIF folio.

As I often do in these situations, I’ve been tweaking my normal screening rules to see what new stocks might be available in slightly different circumstances. This week I’m looking at dividends.

My normal screening rules require a constant or growing dividend. However, many previously reliable dividend stocks suspended their dividends in 2020. They were then reinstated towards the end of the year.

Broadly speaking, I don’t think this temporary pause is reason enough to rule out a share from consideration for SIF. So I’ve created a copy of my screen in which my rules on dividend yield and growth have been suspended. You can see the screen here.

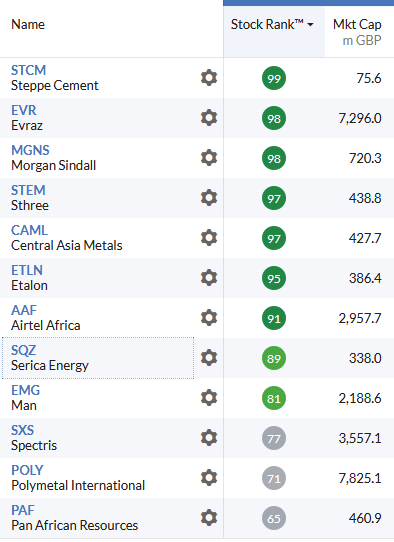

This rule change expands my selection of possible buys from two shares to 12, at the time of writing:

SIF buying screen excluding dividend requirements (18/01/21)

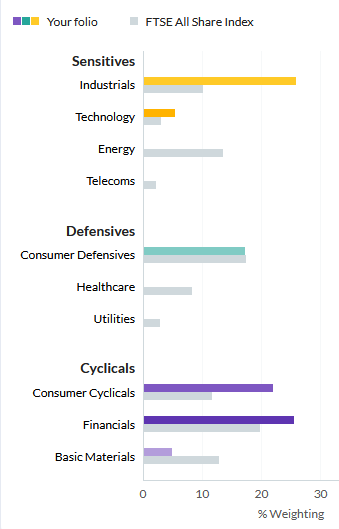

The stock I’ve chosen to look at today is small cap North Sea oil and gas producer Serica Energy (LON:SQZ). The SIF Folio doesn’t currently have any exposure to the energy sector. This is a gap I’d quite like to fill, as I expect to see a recovery in demand after the pandemic.

My view is that in the short term at least, demand recovery will outweigh the growing aversion to fossil fuel producers.

I’ve followed Serica sporadically for a number of years, without ever owning the shares. It’s been my loss. During the 2015/16 commodity sector crash, Serica became an outstanding value play. Investors who bought the stock then enjoyed big gains as the market recovered. Serica then leveraged its cash balance and operating credentials to acquire the Bruce, Keith and Rhum fields from BP.

Almost overnight, Serica became a mid-ranking North Sea producer with substantial cash flows.

The gains enjoyed by shareholders since 2016 are impressive. But the chart also shows that if we ignore last year’s crash, Serica’s share price has gone nowhere since late 2018.

Serica’s StockRank of 89 and Super Stock status suggest that Stockopedia’s algorithms see a potential opportunity here. I think this could be true, but I…