The big miners are reporting incredible profits at the moment, thanks to a China-led boom in commodities since last year’s crash. Dividend yields have inflated to match -- my subject today, Anglo American (LON:AAL), has a 2021 forecast yield of 8%.

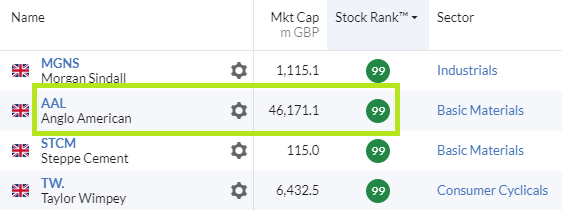

This South Africa-focused FTSE 100 group is a new arrival in my screening results. It’s also currently one of the top-ranked UK shares on Stockopedia:

I’ll say now that I won’t be adding Anglo American to SIF because I already hold commodities group EVRAZ (LON:EVR), which produces coal, iron ore and steel. But I will give a definitive answer on whether I’d buy Anglo for SIF if I didn’t already hold a rival miner.

Why is Anglo doing so well?

Anglo has outperformed its FTSE 100 rivals BHP (LON:BHP) and Rio Tinto (LON:RIO) over the last five years:

I think that one reason for this is the company’s more evenly balanced mix of commodities. Broadly speaking, Anglo has a greater weighting to late cycle commodities such as copper, platinum and diamonds than Rio or BHP.

We can see how Anglo American’s profit split is significantly different to Rio’s in this table:

Underlying EBITDA (%) H1 2021 | ||

Commodity | Rio Tinto | Anglo American |

Iron ore | 75% | 40% |

Platinum group metals | 0% | 36% |

Copper | 10% | 16% |

Aluminium | 9% | n/a |

Diamonds | n/a | 5% |

Other minerals/coal | 6.5% | 2.5% |

Where next for Anglo?

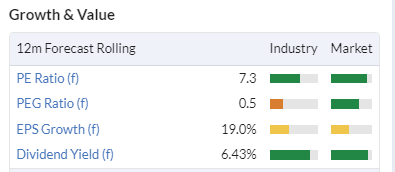

Anglo American’s performance and valuation metrics certainly look tempting at the moment. How often will you see a single-figure P/E, double digit EPS growth and a 6%+ yield?

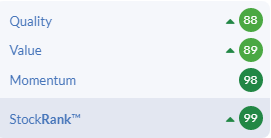

Stockopedia’s algorithms like the shares too. AAL stock currently boasts a StockRank of 99 and Super Stock status.

I can see the ongoing appeal of these shares, but I can also see some reasons to be cautious. In the remainder of this piece, I’m going to drill into Anglo American’s QVM scores and attempt to put the current numbers in context.

Disclosure: There is a severe risk that seller’s remorse could distort my views about this business. I bought Anglo shares at prices between 378p and 900p during the second half of 2015. I then sold for 1,100p+ during the first half of 2017. Had I sat tight and done…