Defensive food and drink companies are often reliable performers, but they’ve been in vogue with investors over the last few years. As a result, these expensive defensives have rarely met the valuation criteria I use when screening stocks for my Stock In Focus (SIF) portfolio.

However, a strong set of recent results from sausage skin maker Devro mean that this small cap dividend stock has now appeared in the results of my SIF stock-buying screen.

Devro’s star has been in decline in recent years, but the outlook now seems to be improving.

I’m interested to find out more, so this £315m stock will be my subject this week.

Devro (LON:DVO)

Glasgow-based Devro produces sausage casings from edible collagen, which the company describes as a naturally-occurring polymer. My understanding is that collagen mostly comes from animal bone, skin and tissue.

The group’s history stretches back to the 1950s, when it pioneered the development of edible collagen casing as part of Johnson & Johnson. Devro was spun out from J&J in 1991 through a management buyout and listed on the LSE in 1993.

Devro’s current product range includes edible casing, non-edible casing, films and plastics. These are used for different types of sausage and meat snacks. The group has manufacturing sites in the USA, UK, Netherlands, China, Czech Republic and Australia. These support customer operations in more than 100 countries.

Devro says it has a leading share of the market in “many countries” and expects global market growth of 2%-4% per year. Growth factors include urbanisation, higher living standards and the trend for increasing protein consumption.

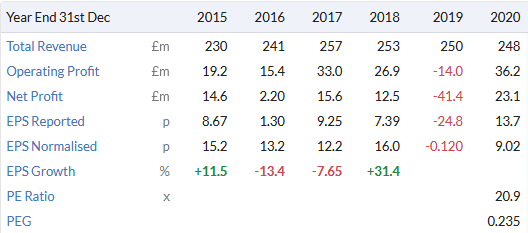

However, Devro’s financial performance in recent years has been inconsistent:

The firm appears to be keen to blame this on former management. The investment case published on its website boasts of a “refreshed” management team. Five out of seven of the executive management team have joined since 2016. This includes CEO Rutger Helbing, who was appointed as CFO in 2016 and promoted to CEO in 2018.

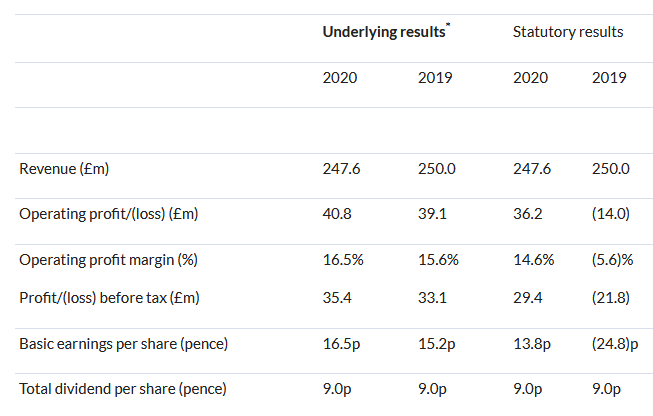

Devro’s 2020 results do appear to show signs of stabilisation and improvement. The company delivered a very stable performance during the pandemic year. Profits and margins rose slightly on broadly flat sales:

According…