This year’s lockdown restrictions have inevitably led to a big shift in alcohol sales from the on trade to the off trade. One company that may have benefited from this is drinks group Stock Spirits.

This £440m group generates over 80% of its sales in the Czech and Polish markets, where its brands are #1 and #2 respectively by market share. Historically, just 15% of Stock’s group revenue came from the on-trade. In May, the company said that trading has seen “minimal impact from the COVID-19 pandemic” to date. However, the near-term outlook remains uncertain, as I’ll explain.

Stock Spirits currently comes very close to qualifying for my Stock in Focus (SIF) screen, only failing due to some broker uncertainty about whether the full-year dividend will be maintained.

The shares also score highly with Stockopedia’s algorithms, with a StockRank of 98. At the time of writing, Stock is also one the top five stocks by rank in the Consumer Defensives sector. That’s no mean feat given the proven quality of some shares in this sector.

This week I’m going to take a closer look at Stock Spirits, with a view to adding this mid-cap to my rules-based SIF Folio.

Stock Spirits (LON: STCK)

Stock Spirits’ main product is vodka, although the group does have some other notable brands, such as Fernet bitters and Stock brandy. Although the current business was established in 2008 through the combination of Eckes & Stock and Polmos Lublin, some of Stock’s main brands have a history that stretches back more than 100 years. You can see a complete list of brands here.

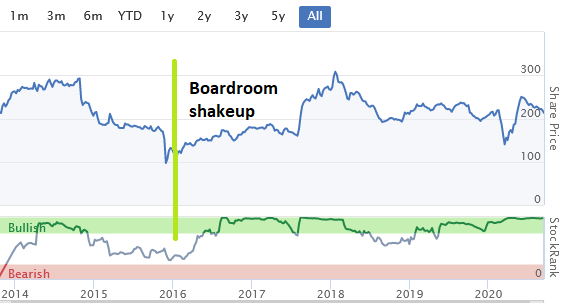

Stock Spirits has been listed on the London market since 2013, but I think it’s fair to say that progress to date has been limited. The shares have traded sideways since joining the market:

For potential buyers today, I think it could make more sense to look at this chart from 2016 onwards, when a new CEO and boardroom shakeup followed a period of poor results. The changes were triggered when Portuguese businessman Luis do Amaral took a 10% stake in the group.

Mr Amaral is the controlling shareholder in Polish wholesale group Eurocash, which in 2016 was said to be Stock Spirits’ largest customer.

Since 2016,…