I don’t have a rigid policy of sector diversification for my systematic SIF Folio, as I think that runs counter to my policy of buying the top-ranked shares highlighted by my SIF buying screen. But I do try to ensure a reasonable spread of sector exposure across the portfolio’s holdings.

Given that stocks which pass all of my buying rules are still thin on the ground, I’ve decided to take a slightly different approach this week in my hunt for the next SIF stock. I started by taking a look at the current sector allocation profile of the SIF folio, using the Allocation tab in Folios.

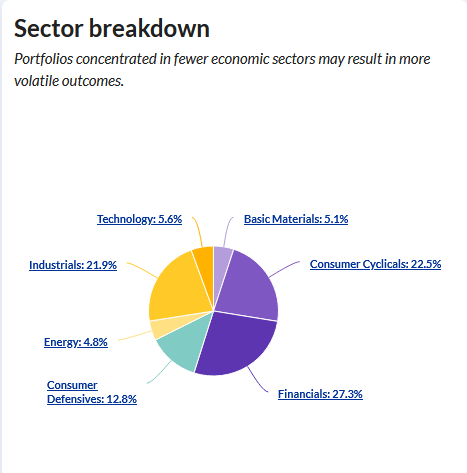

To start with, here’s a snapshot of the portfolio’s current holdings by sector:

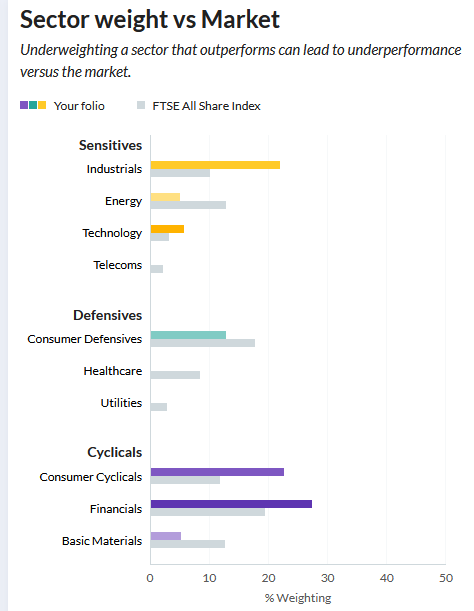

Next, here’s a second view showing portfolio sector weights versus those of the wider market. This makes it easy to see where your portfolio differs from the market. In this case, we can see that SIF has no exposure to the Telecoms, Healthcare and Utilities sectors. Elsewhere, the portfolio’s weightings are significantly different to the market average:

I would like healthcare exposure, but nothing even comes close to passing my screening rules at the moment and I’m not willing to overpay. I’m less worried about telecoms and utilities. I think there are some good options for income investors in these sectors, but I’m less convinced by the case for growth and total return.

I don’t try to match the market’s sector weightings, as I think that some differentiation is needed to have any chance of beating the market. However, I wouldn’t be averse to adding more exposure in Basic Materials or Energy.

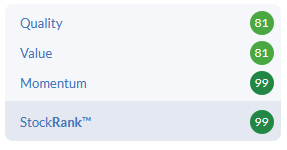

Having reviewed some possible options, the stock which comes closest to satisfying all of my requirements is FTSE 100 coal, iron and steel group Evraz (LON:EVR). Stockopedia’s algorithms have a favourable impression of this stock, awarding it Super Stock status and a high StockRank:

Evraz (LON:EVR)

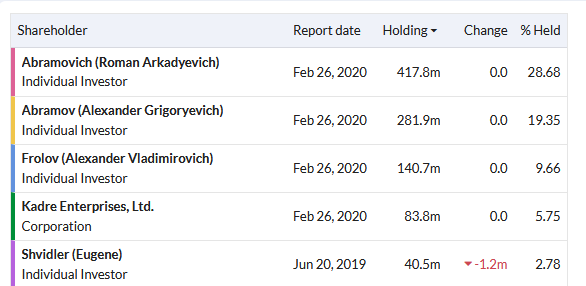

Evraz has Russian origins and concentrated private ownership. I tend to think of such companies as oligarch stocks.

The group’s largest shareholder is Chelsea FC’s billionaire owner, Roman Abramovich:

I’m normally reluctant to invest in Russia-based firms. My perception is they suffer from political risks and a certain lack of transparency.…