Last week’s decision to sell pawnbroker H&T Group and gold mining services provider Capital means that my SIF folio has no exposure to gold. In a world of zero interest rates and macro uncertainty, that may not be ideal.

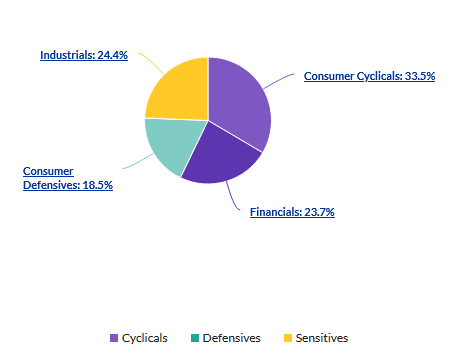

I have to fess up to another problem with the portfolio this week, too. The 16 stocks in SIF are concentrated in just four top-level sectors:

In my defence, this isn’t specifically a breach of my rules. But it’s not necessarily ideal. Adding a gold miner would provide exposure to a commodity that tends to perform well in difficult times. It would also add a fifth sector - Basic Materials - to my portfolio.

Although I’m concerned about the risk that the gold market will peak, I accept that we may not be at that point yet. As far as I can see, there’s not much sign of the froth that has marked the high water level of previous commodity booms. Gold equities don’t look obviously mispriced to me.

In any case, my rules are designed to prevent me taking macro positions and instead focus on selecting companies with attractive characteristics. The SIF screen is not currently identifying many opportunities in the UK market:

Of these, Wynnstay and Morgan Sindall are already in SIF.

Highland Gold Mining is in a bid situation.

TP ICAP would be a possibility, but I already have several financial stocks. This share also has the lowest StockRank in the screen results.

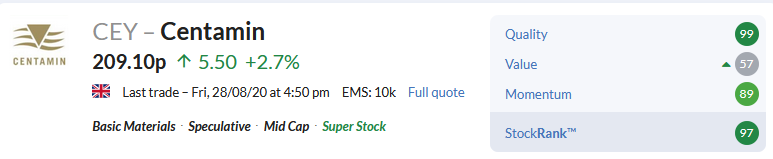

My rules specify that my screening results should be ranked by StockRank, which means that FTSE 250 gold miner Centamin is the only possible choice this week.

Centamin (LON: CEY)

I’ve followed Centamin’s fortunes for a number of years. On the whole, I think this Egypt-based firm is a good business. It’s profitable and cash-generative, with a strong balance sheet and track record of attractive dividends.

Stockopedia’s algorithms like the shares too:

However, long-term followers of this mid-cap miner will know that it’s not always been a smooth ride. Although the shares have delivered an impressive 2,500% gain since Centamin’s 2001 listing, keeping the faith has been challenging at times:

Political risk: Leaving aside the gyrations of…