This week I’m going to look at flooring distributor Headlam (LON:HEAD) and consider whether to add it to my SIF (Stock In Focus) portfolio. This popular small cap has impressed over the years and I regret not buying it in last year’s crash. I’ll be interested to see if the stock still tempts me after a strong rally over the last 12 months.

Before I start looking at Headlam, I want to take a moment to revisit the system I use to select stocks for SIF. I’ve been running SIF for over five years, but I’m aware that many newer subscribers may not be familiar with the original remit for this virtual portfolio.

In short, my aim is to try and consistently beat the market with a systematic approach to buying and selling shares. So far, I’ve succeeded. The system I use is to select stocks to buy from a screen that’s designed to highlight affordable, good quality businesses with positive momentum.

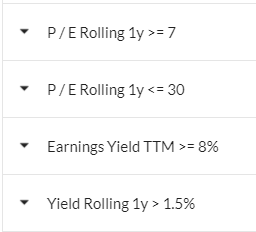

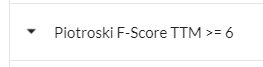

You can see the full version of this screen here. But the screenshots below show how my screening criteria map onto the three core factors used to power the StockRanks - quality, value and momentum.

Valuation

Quality

Momentum

This is only a snapshot of how SIF works. There are some other rules involved in my buying decisions, and I have a separate set of rules for selling stocks. But I hope this provides a useful starting point for understanding how this portfolio is run.

Headlam (LON:HEAD)

Headlam describes itself as “Europe’s leading floorcoverings distributor”. The company says it’s six times larger than its nearest peer and has the “broadest product range” in the market.

This £425m business operates 66 businesses in the UK, France and Netherlands. Each of these operates under its own trade brand, but benefits from Headlam’s sourcing and logistics network, plus other centralised resources.

One way to look at Headlam’s business model is as an aggregator. It buys centrally and in size and then sells locally to many small customers. By doing this, the group can secure better pricing. Headlam’s operating businesses and their customers can then benefit from a wider choice of products, at more competitive prices.

…