My simple and perhaps old-fashioned valuation criteria rule out stocks with nose-bleed valuations. So I haven’t had a chance to buy into the UK’s largest tech play, food delivery service Just Eat Takeaway.

I can’t say I’m sorry. JET required a global pandemic to make it profitable and currently trades on 95 times 2021 forecast earnings. I’m not sure how much upside is left, as the evidence this year suggests that people will return to dining out just as soon as they’re allowed to.

For my money, Stocko’s classification of JET as a Momentum Trap is spot on. However, I can recognise the structural growth potential inherent in many businesses in this sector. Luckily, UK tech stocks have been left behind somewhat by their US rivals this year. As a result, I think there is some value on offer elsewhere in the UK tech sector.

I’ve been hoping to find an opportunity to add some tech exposure to SIF, which currently has none.

I think I may have found an opportunity that could tick all the boxes. FTSE 250 precision measurement firm Spectris (LON:SXS) is a new arrival in my stock-buying screen. This £3.2bn business is the ninth largest stock in the UK technology sector. Happily, Spectris also has some old-fashioned fundamental attractions for nervous types like me.

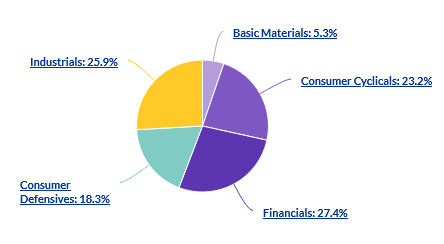

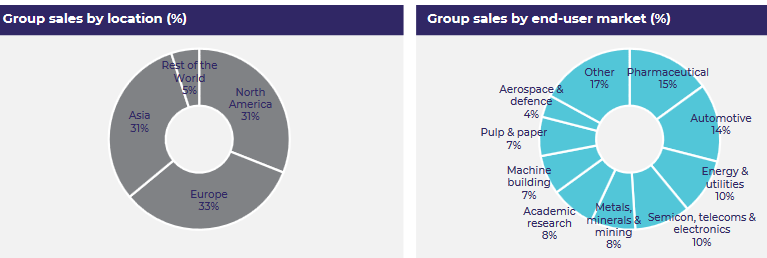

For one, it makes money and has done for many years. Stockopedia shows a six-year average operating margin of 13%, with a matching return on equity. Spectris generates cash, pays dividends and maintains a strong balance sheet. The valuation doesn’t require a leap of faith and Spectris’s customer base includes all major sectors and geographies:

Source: Spectris 2019 fact sheet

Spectris has four operating subsidiaries which sell directly to clients, building lasting relationships. The group sells measuring instruments and sensor technology, along with related software and services.

I believe demand for such products should be underwritten by structural growth for many years to come. Consider the global market for sensors and related software, for example. Apart from short-term cyclical dips, I can’t really see any scenario where demand for data capture and operational monitoring is likely to decline.

I should have kept the shares in 2019

As it happens, I’ve bought Spectris before for SIF. I last sold…