The recent stock market wobble has combined with growing caution economic growth to cut the results of my SIF folio share buying screen to just eight stocks. Most of them are already portfolio members, or else are unsuitable for some reason.

By disabling individual screening rules, I can see that valuation and weakening momentum are the main roadblocks. Disabling either my earnings yield or 1yr relative strength rules increases the number of qualifying stocks from eight to over 30.

In search of new ideas, I’ve turned to the relaxed version of my screen. This offers a wider range of stocks, due to slightly more relaxed valuation criteria.

My rules stipulate that I shouldn’t buy from the relaxed screen unless I’ve been unable to buy a stock from the main screen for at least four weeks. For this reason, I won’t add a new stock to the portfolio this week. But I might be able to line up a potential purchase for some time in the near future.

iEnergizer (LON:IBPO)

The company I’ve chosen to look at is £746m AIM stock iEnergizer, an outsourcing group based in India. iEnergizer’s services are divided into two segments:

- Business process outsourcing (63% of FY21 revenue): providing services such as call centres, technical support and back-office services. Sectors include healthcare, banking, insurance and gaming.

- Content delivery (37% of FY21 revenue): outsourced provision of eLearning and digitisation services

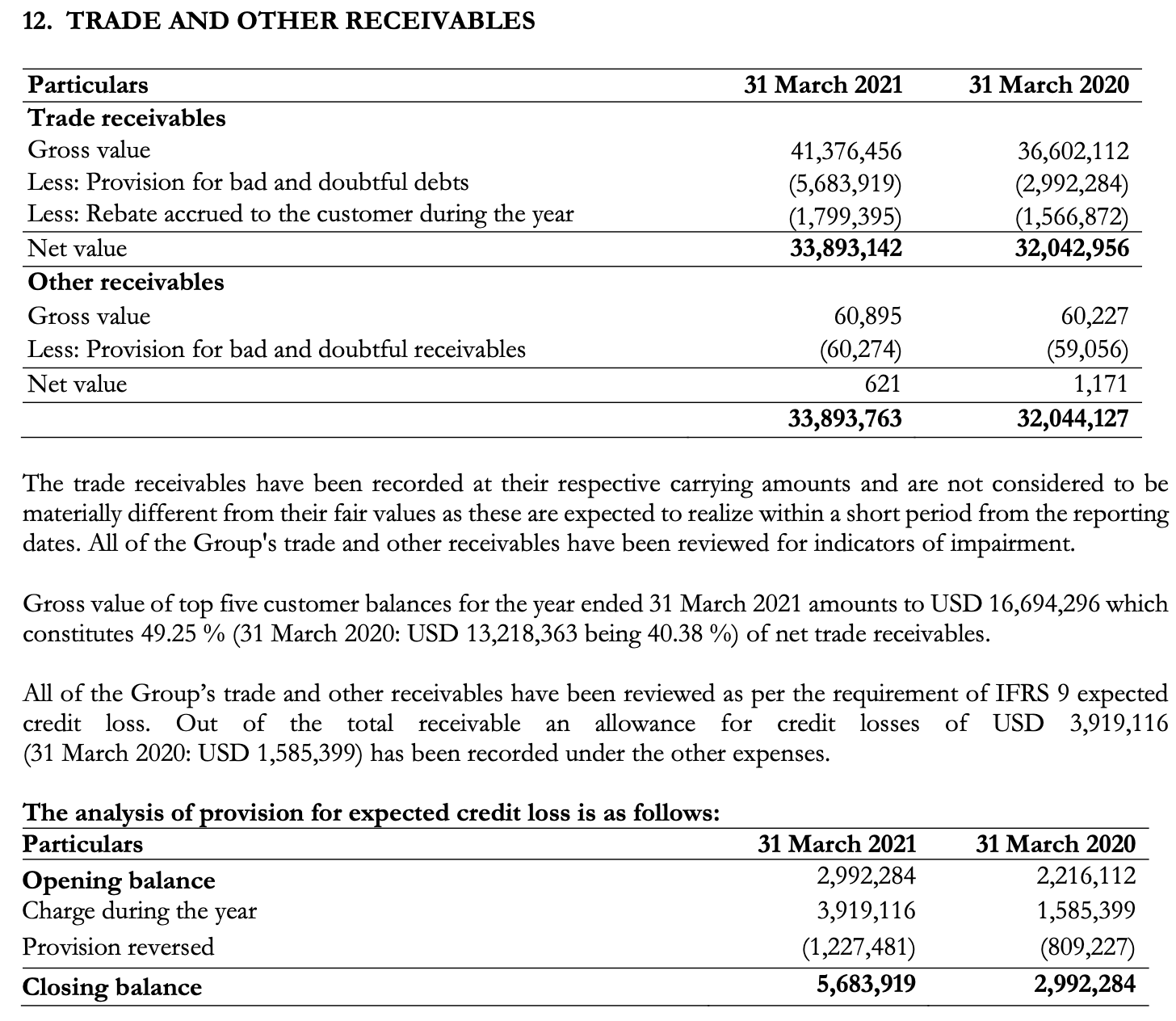

It’s a fairly sizable business, with revenue of $200m and $60m of profit last year. I’m not sure if the company has much of a following among UK investors, but the shares have been a multibagger for investors who have spotted the opportunity in recent years:

These share price gains have been backed by solid profit growth:

And the business appears to have gained the support of a number of well-known institutions:

The elephant in the room here is the presence of controlling shareholder and founder/CEO Anil Aggarwal, who effectively retains complete control over the business. iEnergizer’s free float is small, at 17%. Although liquidity does not seem too bad, I’d guess it could be a problem during a sell-off.

iEnergizer is well-rated by Stockopedia’s algorithms and has strong quality and momentum scores.