Next week will mark the fifth anniversary of the SIF portfolio. It’s fair to say that when I started out in April 2016, I didn’t foresee Brexit, Trump or Covid-19. Despite these challenges - or perhaps because of the market opportunities they created - SIF is currently trading at all-time highs.

I’ll look at the performance numbers next week and discuss the lessons I’ve learned so far.

This week I’m going to look at a possible addition to the portfolio, building products manufacturer Alumasc (LON:ALU).

Alumasc has been in business in various forms since the mid-20th century. In the 1980s and 90s the group made aluminium beer barrels and precision engineering components. The focus then shifted to aluminium rainwater and drainage products.Today, Alumasc produces three main lines of building products, sold under a number of different brands:

Water management: rainwater drainage and floor drainage systems for industrial, commercial and residential applications

Building envelope: roofing, balconies and solar shading

Housebuilding products: Sold under the timloc brand, these include a range of technical products with a focus on ventilation and insulation. For example, air bricks, roofline vents and cavity wall closers.

As far as I can tell, Alumasc has some decent products and brands. The company says that almost 80% of sales are driven by architects and structural engineers. This is due to the performance characteristics of the firm’s products, which help meet modern building regulations.

Another factor which looks positive to me is that export sales are significant (13% of revenue) and growing (up 23% in H1). I’d tend to see this as evidence the firm’s products have some degree of competitive advantage, and are not simply commoditised building materials.

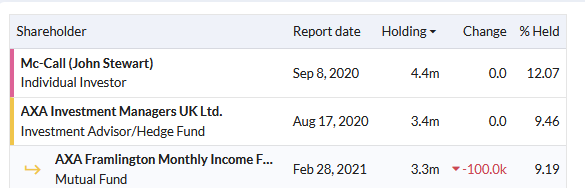

I’m also encouraged by insider ownership. Alumasc is still chaired by John McCall, who took the company private in 1984 and floated it in 1986. Mr McCall has a 12% shareholding, which should align his interests with those of shareholders.

A good time to buy?

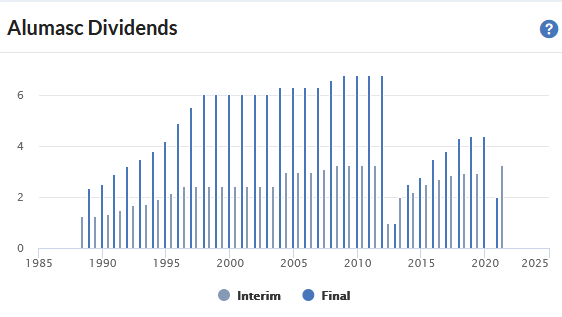

This £70m firm is a company I’ve followed on and off over the years, without ever owning. There are a couple of reasons for this. One is that Alumasc’s results haven’t always been consistent. The firm has been through some difficult patches over the last decade, as the dividend history suggests:

However, after a rough patch in 2019, performance seems…