Buying shares that are trading at all-time highs is probably the investing activity I find hardest of all. By nature I’m a value investor. I have to constantly remind myself of the importance of momentum in generating positive returns.

However, one of the joys - and challenges - of running a rules-based portfolio like SIF is that I must sometimes make decisions that go against the grain. After all, the whole point of systematic investing is to eliminate bias and make consistent decisions that are backed by quantitative evidence.

As you might guess, this week I’m going to consider whether to add logistics operator Wincanton (LON:WIN) to the SIF folio. This stock is currently trading close to its all-time highs:

If we zoom in to look at the stock’s year-to-date performance, we can see the share price has been consolidating for the last three months. Is this a precursor to a move upwards (or downwards), I wonder?

Wincanton (LON:WIN)

Wincanton specialises in supply chain logistics. That means taking ownership of warehousing, order fulfilment, transport fleets and deliveries for clients. It’s an outsourcing business and Wincanton says it’s the biggest British company of its kind, with nearly 8,000 vehicles and 15.3m square feet of warehouse space.

Many of Wincanton’s clients are in the retail sector, including Asda, B&Q, Screwfix and Ikea. The firm is also active in the construction and bulk logistics sectors.

Stockpedia’s algorithms have a positive view on the firm, awarding WIN shares a StockRank of 89 and Super Stock status. This £512m business has also made a recent appearance in my screening results, making it a potential buy for the SIF folio.

Should I buy Wincanton for SIF? Let’s take a closer look at the numbers.

Value: Weak foundations

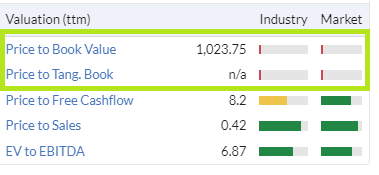

Wincanton’s ValueRank of 70 does not appear to suggest any serious concerns. And at first glance, everything seems fine. The shares trade at 13 times pandemic-hit 2020 earnings and offer a 2.5% yield. Cash generation seems good. Wincanton’s trailing EV/EBITDA ratio of 6.9 also looks reasonable to me.

However, a closer look at the numbers reveals a more complex picture. The stock’s price/book value gives us the most obvious clue - apparently Wincanton’s balance sheet has almost no equity: