The rapid recovery of the stock market since March has been a pretty amazing experience. Will this be mirrored with a rapid economic rebound? There’s no way to know.

My instinct is to be skeptical. I’m not yet convinced that corporate earnings in 2020/21 will justify the rebound we’ve seen in the markets. When companies start issuing guidance again, I think we could have a few nasty surprises.

Of course, I would be very happy to be proved wrong.

Screening for consistency

Luckily, my trading decisions for the SIF Folio don’t depend on my macro views.By using a stock screen to pre-qualify stocks for the portfolio, I can be sure that the companies I select enjoy consistent characteristics.

Screening also has a second advantage, in my view. It gives me an objective way of comparing market conditions at different points in time. The number and variety of stocks which qualify for my screen at any one time provides an interesting window on valuation, momentum and earnings.

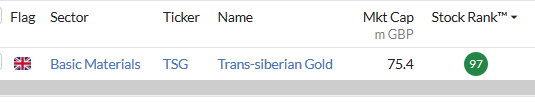

The message I’m getting today is that opportunities for affordable growth backed by strong fundamentals and positive momentum are limited. Only one stock qualifies for my screen at the time of writing. Unsurprisingly, it’s a Russian gold miner:

I don’t really want any more exposure to gold. I’m already exposed to this sector through Capital Drilling. I also have a general policy against buying Russian stocks.

Taking a broader view

It’s been four weeks since I was last able to add a new stock to the SIF fund. This means that my rules allow me to relax my valuation and growth criteria slightly in search of new opportunities. I maintain a separate copy of my screen for this purpose, which you can find here.

This screen provides some slightly more interesting results:

This time, we start with two Russian gold miners. Moving on, we find AIM-listed small caps K3 Capital and Cake Box Holdings.

Although I’d like more defensive stocks, I already own cake maker Finsbury Food. So the only stock I can consider is K3 Capital.

K3 Capital (LON:K3C)

I have to admit I was not familiar with K3 before I started working on this article. It turns out that this…

.JPG)