The news doesn’t seem overly encouraging at the moment. COVID-19 case numbers are rising sharply. US tech stocks have started to wobble. The FTSE 100 is down nearly 10% from its May high of c.6,500. And a hard Brexit might be on the cards again, as press reports suggest the UK government may choose to override parts of the EU withdrawal agreement.

Against this backdrop, it’s encouraging to find companies that have performed well in 2020 and are expected to continue doing so. One such company is last week’s selection, FTSE 250 gold miner Centamin.

This week another stock which trades in the Basic Materials sector has appeared in my Stock in Focus screening results - small cap packaging group Macfarlane (LON: MACF). This £140m business has previous form in my SIF fund. In 2016, a previous position resulted in a disappointing 10% loss. In 2018/19 my Macfarlane trade delivered a more credible 30% gain for SIF.

Macfarlane (LON: MACF) - opportunity from adversity?

Macfarlane’s share price has bounced around since late 2019, but has not really gone anywhere. However, the firm’s recent half-year results looked fairly positive to me. Strong demand for packaging items for internet retail, household goods and medical products helped to offset weaker demand from the automotive sector and high street retailers.

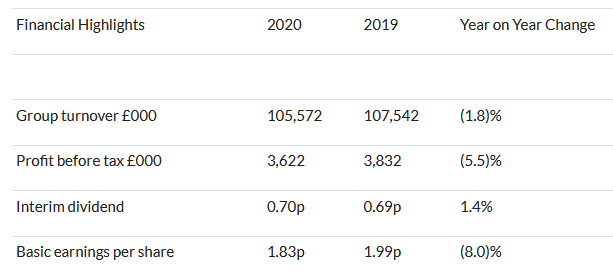

Although H1 sales and earnings were down slightly on the same period last year, the decline was fairly modest in my view:

Macfarlane passes all of my screening tests. Stockopedia’s algorithms appear to like it too:

With the firm’s peak trading period still ahead of it this year in Q4, this could be an opportunity to buy into a stock with the potential to beat expectations.

What could go wrong?

Playing devil’s advocate for a moment, it’s certainly easy enough to construct a generic case against this group.

In general, I’d imagine that there will always be pressure on profit margins from rivals and customers. Macfarlane may also lack the economies of scale and diversity of larger rivals.

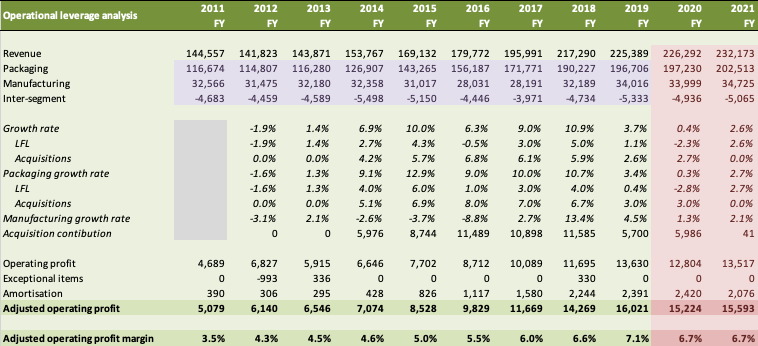

A more specific concern for me is whether the group’s manufacturing division really justifies its presence in the group. Whereas Macfarlane’s packaging distribution business generated an operating profit of £12.4m in 2019 at a margin of 6.3%, manufacturing contributed just £1.2m…