Are markets fully priced at the moment? I think there are pockets of value available to stock pickers. However, one crude measure of valuation suggests to me that in broad terms, share prices may be up with events.

The measure I’m talking about is the stock screen I use to select shares for my SIF (Stock In Focus) portfolio. To recap briefly, the screen (which you can see here) contains a set of rules relating to value, quality, growth and momentum.

The number of shares which pass all of these tests varies widely. Given that the screen criteria remain unchanged, I see any significant variation in the number of qualifying shares as a crude indicator of how underlying market conditions might be changing.

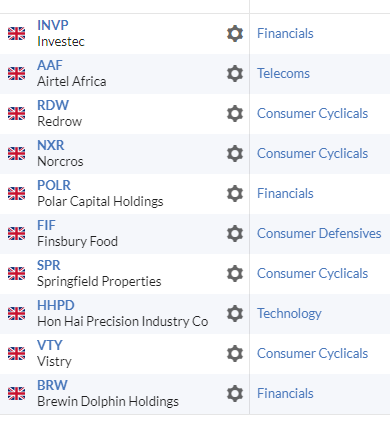

For some time now I’ve found that relatively few stocks have been qualifying and they’ve come consistently from just two or three cyclical sectors - mostly housebuilding and finance. Here are the SIF screen results at the time of writing:

When this happens, one trick I use to understand the underlying market conditions is to disable one screening rule at a time.

I usually find that there’s one rule holding back a flood of additional stocks. I’ve been doing this today. By disabling a single rule, I’ve been able to increase the number of shares in my screen’s results from 10 to 44.

Valuation matters

To be clear, these 44 stocks match all but one of my screening criteria. The one they fail relates to valuation.

The primary valuation metric I use for SIF is earnings yield, or EBIT/EV. It’s a measure made popular by Joel Greenblatt in The Little Book That Beats the Market. I find it very useful for any investing approach which includes a focus on valuation.

In normal times I require a minimum earnings yield of 8%, which is equivalent to a EV/EBIT (or operating profit) multiple of 12.5x. I sometimes reduce this to 6%, but today I’ve omitted this requirement altogether.

One of the top-ranking stocks in my amended screening result is FTSE 250 materials engineering group Morgan Advanced Materials. Although this company is a £1bn FTSE 250 group that’s been in business for 165 years, I’ve never looked at the shares in any depth. I’m not sure why this is, but I plan to address this oversight in the…